As hotel owners begin to navigate the post-COVID world, they are increasingly becoming more aware that it is important to “right size” their portfolio and dispose of non-core assets. With that, we have uncovered two topics on the state of the hotel transaction market that seem to be on top of everyone’s mind – what does pricing look like and who are the buyers?

Contributed by Eric Guerrero and James Rebullida, HVS

What does pricing look like?

The transaction market has gained steam this year, and we have been pleasantly surprised at the offer/bid activity on the transactions that we have marketed for sale, due primarily to all the undeployed capital that was raised during the height of the pandemic. Looking back at the distressed asset sales since the start of the pandemic, they have only accounted for 8.7% of the overall transaction market.

With all the capital raised and the low supply of deals, investors have been aggressively competing against one another, resulting in upward pressure on pricing. The competitive environment has been beneficial to sellers by tempering the discounts to pre-COVID values. On transactions that we handled during the pandemic, we have seen discounts from as little as 3% to as high as 35%, compared to their pre-pandemic values. However, with the increasing buyer activity this year, we are expecting pandemic discounts to creep down to less than 10% of their pre-pandemic value.

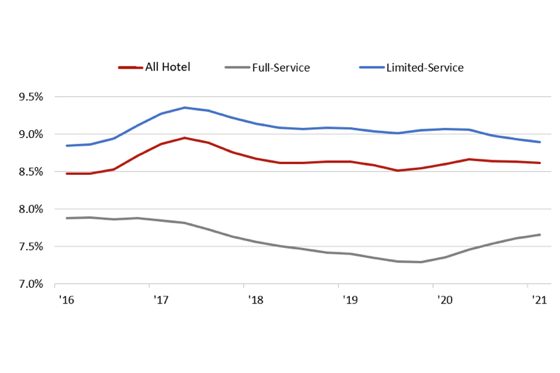

In Q1 2021, there was US$5.6 billion in hotel transaction volume, representing a 13% year-over-year change in volume. Limited-service hotels represented US$2.9 billion of that transaction volume and will continue to be a sought-after asset class from buyers. When surveying the RCA Hedonic Series capitalization rates, full-service hotels were at a 7.7% cap rate in Q1 2021, reflecting an increase of 30 basis points (bps) over the Q1 2020 cap rate. On the other hand, limited-service hotels experienced cap-rate compression and were at an 8.9% cap rate in Q1 2021, reflecting a decrease of 20 bps from the same period last year. Given that limited-service hotels have performed much stronger throughout the pandemic than full-service hotels, it is no surprise that the pricing has been compressed with all the buyer activity.

RCA Hedonic Cap Rates

Source: Real Capital Analytics

* The RCA Hedonic Series (RCA HS) is an enhanced suite of cap rate and pricing time series which provide an alternative to RCA’s existing average yield and average price per unit time series. It differs from the average yield/PPU series in that the methodology reflects pricing for the average property rather than an average of the prices of properties that have transacted.

Who are the buyers?

With all the uncertainty surrounding the industry last year, we noticed an uptick of opportunistic investors with fresh capital seeking assets to purchase at a discount. Private equity companies and REITs have raised funds that strictly focus on distressed deals. While lenders are still hesitant on lending, many of these investors have been acquiring hotels with all equity or with very low debt. Most of the acquisitions by these firms are large portfolios, full-service assets in major metropolitan areas, and mergers between companies.

On the other side of the spectrum, there has also been an increase of private investors seeking to take advantage of the government-backed SBA relief programs under the CARES Act. These acquisitions are typically single-asset trades with values below US$8 million. Through September 2021, the SBA program offers new borrowers a reduction in origination fees and subsidies on the monthly principal and interest payments. We expect the activity in this segment to continue growing unless the government discontinues the program beyond September.