Proof of concept. In March 2024, Hilton agreed to acquire Graduate Hotels from AJ Capital Partners in a deal valued at a reported $210 million. By doing so, Hilton can lean on its vast resources and inroads with the owner community to franchise the brand, which now totals more than 30 hotels in and around college campuses. That is the brand’s motivation: locate hotels where a university serves as the anchor of the community.

Study Hotels, the brainchild of former Starwood Hotels & Resorts executive Paul McGowan, who is now president and founder of the brand and its development arm, Hospitality 3, is in the same class as Graduate: building and operating hotels in college markets that benefit from the demand that universities generate.

If Hilton, a notoriously cocooned company that typically likes to create its own brands rather than buy them, saw it fit to acquire something like Graduate, then it’s reasonable to suggest that Study Hotels demonstrates that the concept works.

In late 2023, The Study at Johns Hopkins, in Baltimore, Md., opened, the fourth hotel in Study Hotels’ portfolio, joining The Study at Yale, in New Haven, Conn.; The Study at University City, in Philadelphia; and The Study at University of Chicago.

So far, Study Hotels has planted itself in strong academic towns that are decidedly urban in nature, not yet penetrating college towns with larger campuses or ones known more for their sports and social aspects than for their scholarship.

Maybe that is the point. The idea for Study Hotels, which McGowan launched in 2008 off a successful career developing brands like W for Starwood, was based on a simple premise and an identifiable gap in the market: college towns, for the most part, didn’t have great hotels. It wasn’t a legion of feasibility studies or reams of market performance data that convinced McGowan, it was personal experience. Like most parents, when their kid comes of age, and it’s time to start considering colleges, dad or mom or mom with dad, load up the car and head out on the highway to check out schools.

Beyond checking out the student union, library and social scene, they must, too, check into a hotel. Some of the accommodations don’t oftentimes match the caliber of the institution. “We were traveling around, looking at colleges with my daughter, and staying in some pretty lousy hotels,” McGowan recalled. “I was trying to understand why these markets weren’t served with higher quality hotels, especially at an institution like Yale,” which is where Study Hotels ended up planting its first flag, 16 years ago. (For the record, his daughter ended up at Cornell.)

Back then, McGowan thought to himself: “There’s got to be a way to accommodate the needs of this institution,” while also making it financially successful.

COLLEGE BOUND

McGowan through Hospitality 3 acquired what was the former Colony Inn on Chapel Street, next to Yale’s Schools of Architecture and Design, gutted it, and took it from 86 rooms to 124 rooms by adding two additional floors—a wood, bronze, stone and glass paean to the gothic-style buildings that dot the campus of a school that dates back to 1700. Upon opening (the hotel, not the university), The New York Times wrote a favorable review of the hotel’s restaurant, Heirloom, calling special attention to the now off-the-menu clam chowder, the author referring to it as “particularly good here.”

“We put a lot of energy into figuring out how to redevelop that asset,” McGowan said. The result has been an occupancy and rate leader. Proof of concept.

It doesn’t come easy. University towns are a draw, but they don’t provide year- round demand. “It’s not 12 months out of the year,” McGowan said, which is why it makes it difficult for a full-service model to work. “The first thing was to prove the viability of that model by entering a market that historically had been underperforming and finding a way to balance the necessary investment with making it financially viable,” he said.

Invariably, he gets the question: Why only four hotels—it’s been more than 15 years? The strategy is the antithesis of larger franchise companies that oftentimes seek out volume at all costs. Each Study Hotels is owned and operated by Hospitality 3, a conscientious decision. “It never made sense to me that you could invest in real estate and then hand over management to someone else without really understanding all of the moving parts and what makes financial success,” McGowan said. “We’re really focused on making every aspect of the development model work—the connection between the real estate and the day-to-day operations—it’s critical.”

Study Hotels’ growth comes mainly through referrals from other universities now, McGowan explained. In the case of Yale, the university wasn’t looking for a new hotel. McGowan and Hospitality 3 created a “market within a market” and in doing so, they, he said, cracked the code of the college market. “We’re finding ways, we’re creative and nimble and that’s what it takes. We invest a lot in the community and making sure that we make those connections—so it’s a bit old school,” he said without a hint of irony.

Hilton’s purchase of Graduate Hotels was a lesson in Acquisitions 101: it was buying a mature market leader with hotels from Oxford, England, to Oxford, Mississippi. “Adding Graduate Hotels accelerates our expansion in the lifestyle space by pairing an existing much-loved brand with the power of Hilton’s strong commercial engine to drive growth,” Hilton President and CEO Chris Nassetta said at the time, adding that the addressable market for the brand represents 400-500 hotels globally.

MARK OF DISTINCTION

McGowan is well aware of Graduate Hotels’ mark on the sector and though the two brands technically serve the same types

of markets, there are vast distinctions, he said, believing Study and Graduate to be very different. “Our brand is designed to accommodate curious lifelong learners,” he said, adding that he was unaware of Graduate’s operating model. “Stylistically, for sure, we’re very different.”

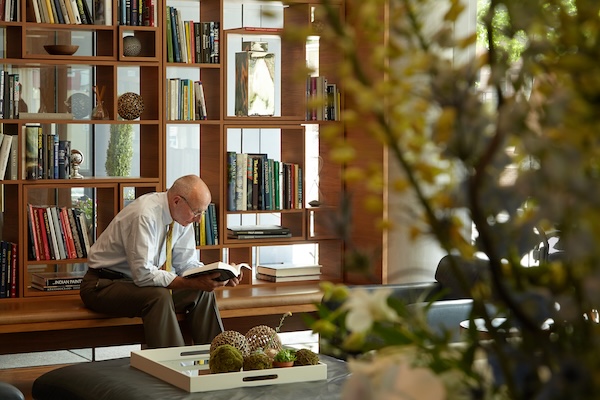

While Graduate Hotels’ lobbies are like pep rallies, Study Hotels is much more reserved in style—less homecoming, more homey. The Study at Johns Hopkins, for instance, is a boutique adaptive reuse on the university’s Homewood Campus. In that way, Study Hotels is more of the location than about the location. Quality over kitsch. A traveler to The Study at University City might think it a premium hotel stay, rather The Living Room at The Study at Yale, which opened in 2008 as Study Hotels’ first property. Photo credit: Study Hotels than a “college-town” hotel stay. “It’s a sophisticated design style, the way we use natural light, for instance” he said. “We try to create inspired spaces.”

Study Hotels’ mantra of “read, rest and reflect” comes through in the design, leather chairs and Ottomans rub up against windows and are backed by shelves of books. The hotel revels in analog: working desk surfaces encourage postcard or letter writing.

One of the major focuses of each of the hotels is food and beverage; each has a signature restaurant. However, they aren’t just a matter of satiating guests, but to keep the hotels as year-round beacons for when school is out of session. “They can’t be as successful in July or January when the school is out of session,” McGowan said. “You want to be able to establish your foothold with the local market, to make that connection.”

McGowan understands, relishes the spotlight now shining on what had been a niche sector. If Hilton’s acquisition of Graduate was proof of concept, it’s induced McGowan to start thinking differently about Study Hotels’ growth trajectory. “We’ve been at it for a while and it’s proved successful,” he said. “Our balance sheet is pretty conservative, but it’s time for us to start thinking about expanding at a different pace than we have historically,” a notable change of tune to how it began.

To achieve that, McGowan might have to go against his fixed notion of retaining ownership over everything—the bricks and mortar and operations. Hotel companies, like Hilton, like Marriott, figured out that to grow quicker, they’d have to pare down their touchpoints—less real estate, less operations, a focus on franchising.

McGowan isn’t ready to give it all up lock stock and barrel, but isn’t averse to a pivot to allow Study Hotels to gain traction quicker. “I can see entertaining the more asset-light strategy and in pursuing management contracts,” he said. “That makes sense now,” alluding to an arrangement of purchasing real estate outright, as it has, or working with the universities on long-term ground leases.

McGowan called Study Hotels’ pipeline “pretty active” with “pretty strong interest,” but was not inclined to volunteer specifics.