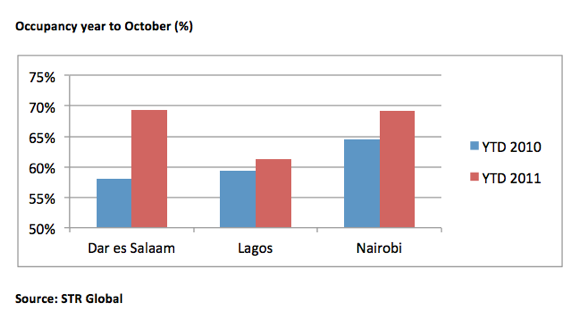

Hotel demand grew strongly across the three main economic centers in Western and Eastern Africa for year-to-date October 2011, compared to the previous year, according to data from STR Global.

Demand grew 27.9% in Lagos, Nigeria, 19.4% in Dar es Salaam, Tanzania, and 10.7% in Nairobi, Kenya.

With limited new hotel supply expected in the near future in Dar es Salaam and 996 rooms in Nairobi’s pipeline, only Lagos is anticipating to almost double its room inventory with an additional 3,038 rooms at different stages of development.

In Lagos, Nigeria’s main economic hub and third largest city in Africa behind Cairo and Kinshasa, hotel market performance was led by growing occupancy, up 3.2%, compared to the previous year benefiting from strong demand by oil-related industries and the growing non-oil business sectors. The increasing supply in the city resulted in more pressure on price competitiveness. The ADR declined by 9.5% to US$279 for year-to-date October 2011. Despite the fall of Lagos’ ADR, it is still one of the highest across the continent.

On the Eastern coast of Africa, Dar es Salaam, the economic centre of Tanzania, increased its occupancy year-to-date October 2011 to 69.2% (a 19.3% increase) compared to 58% the previous year. The main drivers for such performance have been led by the limited new hotel supply, up 0.1% and the double-digit demand growth at 19%. As the Tanzanian shilling depreciated against the U.S. dollar, losing 30% since January 2011, Dar es Salaam saw declining ADR by 1.4% to US$122.87 year-to-date October 2011, whilst in local currency ADR was up 8.5%. RevPAR grew by 17.6% to US$85.02 during the same period.

In the neighboring country of Kenya, Nairobi’s RevPAR increased by 11.3% to US$103.11, led by increased hotel demand, up 10.7% year-to-date October 2011, while hotel supply growth was more muted, up 3.1% during the 10-month period against the previous year. Occupancy increased to 69.3% year-to-date October 2011 compared to 64.5% the previous year. ADR improved 3.6% to US$148.89, which due to the depreciation of the Kenyan shilling corresponded to a 14.6% increase in local currency.