For almost a year, COVID-19 has altered operations for every business around the world; however, the hospitality industry has experienced a significant jolt as a result of government-mandated shutdowns and travel restrictions. While the recent vaccination efforts offer hope of returning to “normal” by mid-summer, many people are still hesitant to resume traveling, and hotel owners are requiring support to bridge them to the other side.

Contributed by Alexander Cohen, CEO, Liberty SBF, which has funded over US$1 billion in loans to small and middle market businesses, Los Angeles

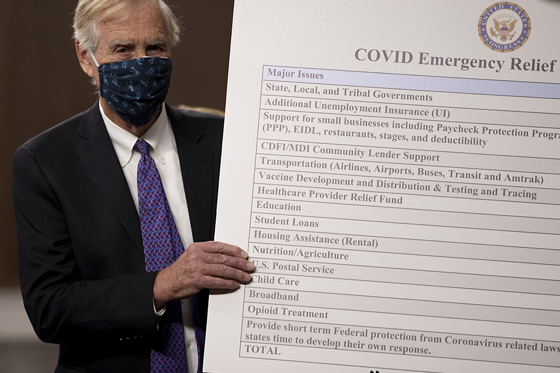

Present challenges for the industry include maintaining staff, restarting operations, and returning to pre-pandemic booking cadence. Most owners know about the Paycheck Protection Program (PPP) loans, but there are several other government stimulus programs to consider. Here’s how hoteliers can take advantage.

First, second draw PPP loans

Hoteliers are able to apply for first-come, first-serve PPP loans under the CARES Act through the Small Business Administration (SBA). The first round of PPP loans provided funding for hotel owners who have less than 500 employees to retain their workforce at 2.5 times their monthly payroll, plus additional expenses.

As a result of the success and interest from borrowers, a second round of PPP loan relief was initiated at the end of 2020 authorizing up to US$284 billion within the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act. Even though we are well into the second draw, hotel owners who haven’t received a first draw loan can still apply, and borrowers who secured a first draw loan can also apply for a second draw loan.

Second draw loans focus on businesses who have used their entire first draw loan and require additional funding; however, to meet eligibility, these businesses must have fewer than 300 employees. For hardest-hit industries, including hotels, the second round offers funding for up to 3.5 times payroll, making the loan expenses tax-deductible. To be eligible, employers must show a 25% or greater reduction in gross revenue through one of two ways: providing proof of their 2020 annual gross revenue via their 2020 tax return compared to 2019, or showing gross revenue in any quarter of 2020 compared to revenue in the same 2019 quarter.

The SBA decided to make several loan forgiveness changes in the borrower’s favor, and all loans are not taxable. Under the new legislation, borrowers with loans under US$150,000 will have a significantly simplified forgiveness process that only requires the completion of a one-page attestation confirming they have met the requirements of the program.

Legislation allows for US$284 billion in funds to be dispersed, so hotel owners should apply as soon as possible to secure funding. If the business has an existing relationship with a bank, they should work directly with their lender to expedite the process. However, hotel owners who do not have a previous relationship with a local bank should also consider applying through an SBA-approved non-bank lender who has dedicated resources to expedite the process and distribute funds in a timely manner. Hotel owners can find necessary resources such as document checklists and loan forgiveness information online through the Small Business Association, local banks, and non-bank lenders.

SBA 504 and 7(a) loan relief

As a part of the CARES Act, the SBA is providing US$3.5 billion in additional COVID-19 relief, some of which is authorized for use through the 504 and 7(a) loan programs for both existing borrowers and on newly originated loans to help small business owners during the pandemic. For those who are considering applying for a 504 or 7(a) loan, here are the differences between both programs to help determine which option is the best fit.

The 504 loan program is a commercial real estate financing program where funds can be used to buy a building, finance ground-up construction or building improvements, or purchase heavy machinery and equipment. The program was designed for owner-occupied properties that require only a 10 percent down payment by the small business owner with funding ranging from US$125,000 to US$20 million. A 504 loan’s interest rate is fixed, no outside collateral is required, and it’s amortized over 20 or 25 years. One major benefit to the 504 loan is the fees are much lower compared to a 7(a) loan.

The 7(a) program was originally designed for higher-risk loans and proceeds can be used for short-term or long-term working capital, purchase of an existing business, refinancing current business debt, or purchasing furniture, fixtures and supplies. The maximum loan amount is US$5 million; however the interest rate is adjustable and tied to the prime rate. Collateral is required for this loan, at 90%, and these loans are amortized over 25 years.

Hotel owners who need additional support should consider applying for a SBA 504 or 7(a) loan. Recent updates have made forgiveness even more attractive to new borrowers by forgiving principal, interest, and any associated fees starting with the first payment for loans approved from February 1 until September 30, 2021. Additionally, the following modifications to the program are in effect through September 30, 2021:

– SBA Guaranty Fee on 7(a) Loans and the CDC Processing Fee charged on 504 loans to the borrower are reduced to zero

– For Standard 7(a) loans, 7(a) Small Loans, CAPLines, and Community Advantage Loans, the guaranty fee is increased to 90%

– The current US$1 million maximum loan amount for SBA Express is extended

– The Guaranty Percentage on SBA Express Loans of US$350,000 or less is increased to 75%

The SBA provides this assistance automatically and is capped at US$9,000 per loan per month. It is important to note that loans approved during the period beginning on September 28, 2020 and ending on January 31, 2021 are not eligible to receive any payment relief.

SBA Express Bridge Loans

Another option for hoteliers experiencing loss of revenue is the Express Bridge Loan Pilot Program that allows SBA Express Lenders the authority to deliver expedited SBA-guaranteed financing. Borrowers can receive up to US$25,000 of approved funds on an emergency basis for disaster-related purposes while they apply and wait for long-term financing during the pandemic. These loans can provide economic support to hoteliers to help overcome the loss of revenue and can be a term loan or used to bridge the gap while applying for another SBA-related loan. This loan is ideal for a hotel owner who has an urgent need for cash while waiting for other financial assistance to kick in.

Determining the right financing option

The SBA has been proactive in offering a variety of financial assistance for businesses of all sizes during the COVID-19 pandemic, but choosing which option is best for you may be confusing. If you have a strong relationship with your current lender, it’s best to consult with them to ensure you’re participating in the loan program that best suits your needs.

However, for those who don’t have an established relationship with a bank, consulting with a non-bank lender may be the right option for you. With expertise on each SBA lending option and customized application technology, a non-bank lender can help secure the maximum amount of funding to support during these uncertain times.