Hilton CEO Chris Nassetta wasn’t coy on his company’s first-quarter earnings call. Nassetta publicized a forthcoming hotel brand within the extended-stay space, a proclamation typically reserved for a larger stage than an analyst call.

And he wasn’t short on details. Though no name was given, the brand will be positioned in the extended-stay space, at the lower end of midscale and a notch below Home2 Suites, which is classified as upper-midscale, according to STR chain scales. Hilton has one other extended-stay brand in Homewood Suites, which is considered an upscale product.

It will debut officially, Nassetta said, over the course of the next 30 to 60 days and will be a 100% new-build product, with an “efficient build cost and high margins,” Nassetta said.

Though design details scarce, Nassetta described the brand as a “hybrid efficiency,” conjuring the notion of a studio-type apartment. He said the idea is founded on the notion of mobility that plumed out of the pandemic. He said that while most core extended-stay products have length of stays from five to 10 days long, the new brand could average stays as long as 30 days. “It’s not competing with Home2 or Homewood,” Nassetta said, adding he anticipates hundreds of hotels over time.

With a potential ADR in the range of $80-$90, the brand is targeting younger cash-strapped travelers. Nassetta referred to the network effect and getting them “hooked on our system.”

Hilton and its peers have pivoted in the aftermath of the pandemic and within the context of current macro-economic headwinds. Hilton, for one, has leaned into the midscale and economy spaces. In January, Hilton unveiled Spark by Hilton, a conversion product for what it calls the “premium economy” segment. As ground-up development stalls with higher interest rates causing a credit crunch, cheaper methods of development are, in some cases, preferable.

“Conversions are a big focus of ours,” Nassetta said. “Spark is most disruptive thing we’ve ever done and the timing is convenient as it depends very little on financing.”

Nassetta said that many brand conversions happen on a transaction or a change of ownership. He said that it can be as cheap as $2 million to convert to a Spark and “get into our system.” New builds, meanwhile, tend to need vast amounts of financing and take longer to come to market.

Strong Numbers

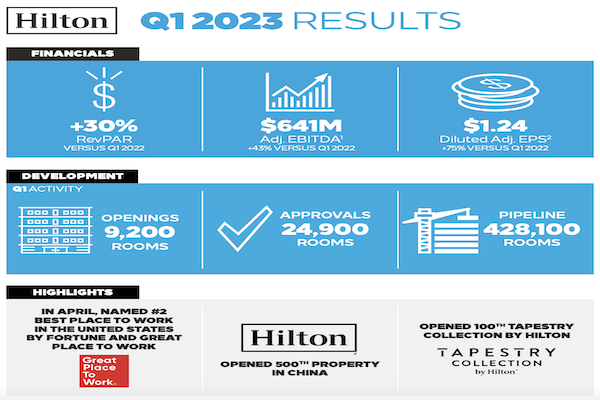

Hilton is one of the first publicly traded hotel companies to report first-quarter 2023 earnings. The numbers were strong and indicative of a strong demand from the traveling public, coupled with the importance of markets across China now opening up.

“Demand for travel remains strong, maintaining the trend of the back half of last year,” Nassetta said. “Despite the macro environment, our network effect and fee-based model will drive growth.”

Net income for the quarter was $209 million, bolstered by a system-wide comparable RevPAR that increased 30% compared to the same period a year ago and up 8% on the first quarter of 2019.

Hilton in the quarter approved 24,900 new rooms for development, bringing Hilton’s development pipeline to

428,100 rooms as of March 31, 2023. It also opened 64 properties, including its 500th in China.

Conversions were 25% higher in the quarter and Nassetta said that Spark has 300 deals in various stages of negotiation.

Hilton’s loyalty program, HHonors, has grown to 158 million member worldwide, with members accounting for 62% of global occupancy.

“It’s an uncertain environment,” Nassetta admitted, but leisure travel is super strong, corporate demand and pricing has returned and group business is motoring.”

Nassetta meets with his global executive team every Monday morning and the first question he asks is: “Are we seeing cracks?” To which he answered: “We aren’t seeing any cracks in demand patterns. We still have pent-up demand and shift of spend on experiences and services. And international travel with China opening up is on an upslope. Capacity additions are at historical lows. Supply and demand is good.”