The FIFA World Cup returns to North America for the first time in more than three decades in the summer of 2026 and on such a large scale that it presents both opportunities and challenges for the travel and hospitality industry.

From June 11 to July 19, the tournament will span 16 cities across Canada, Mexico and the United States. This marks a dramatic expansion in both scope and scale, featuring 48 teams—up from 32 in previous tournaments—and 104 matches, a sharp increase from the traditional 64. With anticipated record-breaking attendance, unprecedented geographic reach and heightened operational complexity, the 2026 World Cup represents a fundamental departure from past iterations. As such, relying too heavily on historical frameworks risks overlooking the unique challenges and opportunities this new landscape presents.

FIFA and the World Trade Organization project a $17.2 billion impact to U.S. GDP from the tournament with the defining feature of the 2026 World Cup its unprecedented geographic scale. The longest distance between two host cities in the 2026 World Cup, Mexico City and Vancouver, is approximately 3,000 miles, which contrasts starkly with Qatar 2022, which had a maximum distance of 34 miles between stadiums. This creates inherent challenges for the cost and complexity of travel, both for fans and logistical support. In addition to no stadium hosting more than one match per day, only 12 of the 104 total matches are scheduled to take place within two days of each other in the same city. In most cases, matches in any given city are spaced at least four days apart.

When considering geographic scale, the 2018 World Cup held in Russia is the most relevant precedent. Spanning 12 host cities, with the greatest distance between them reaching 1,430 miles, there was no universal boost to the hospitality industry across all host cities.

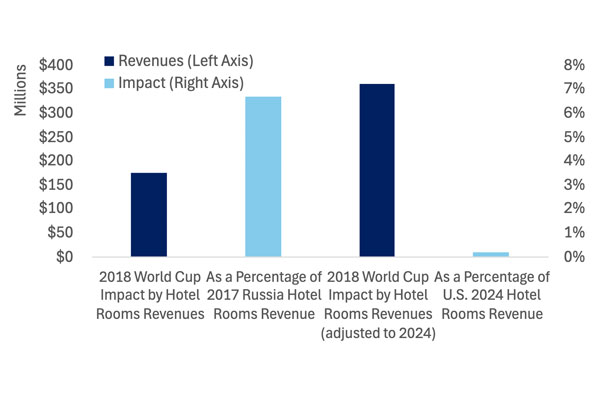

Based on CoStar data, we estimate that Russia saw a 6.7% increase in annual RevPAR, driven entirely by gains in ADR. However, for context, in 2024, Russia sold only 3% of the hotel room volume of the U.S. and its ADR was US$124 compared to the US$159 ADR in the U.S. The revenue impact in Russia was roughly US$175 million in 2018 and adjusted to 2024 dollars would be nearly US$362 million. Though this was roughly a 6.7% positive annual impact on Russia RevPAR, the same revenue increase would translate to just a 0.2% increase in the U.S., even when adjusted for inflation.

Wins & Losses

North America faces even greater structural challenges due to its vast geography and market diversity. However, there are plenty of reasons the revenue impact on the U.S. hotel industry will be more meaningful than experienced in Russia, including:

- a higher base level of ADR

- better travel infrastructure

- more interest from foreign travelers for tourism

Even if the World Cup generates 10 times the hotel rooms revenue it did in Russia, the annual RevPAR impact in the U.S. would be just 1.8%.

Performance also varied significantly by host city. Based on CoStar data, Moscow experienced a 200% surge in RevPAR during the tournament, while St. Petersburg, despite being a host city, experienced declining occupancy and slower ADR and RevPAR growth during the tournament than in the periods immediately before and after. Other markets experienced a modest positive impact relative to the strength experienced in Moscow.

Despite the St. Petersburg example, we expect the event to drive demand to all host markets, but that demand will not be evenly distributed. Gateway cities with strong international appeal, such as New York, Miami and Los Angeles, are positioned to see the most meaningful and consistent gains. These markets already attract global travelers, offer robust hospitality infrastructure and often serve as foreign travel destinations. Additionally, markets such as Atlanta and Dallas, with stellar global accessibility, will host the semifinals matches and should also experience strong gains.

In the Secondary

In contrast, non-gateway cities with more limited tourism appeal may not see much impact at all. For example, Kansas City is scheduled to host six matches, primarily during the group stage—the preliminary tournament rounds. These games are spread out over several weeks, with up to seven days between matches; only two matches are within a three-day window. For markets with limited international tourism appeal and restricted regional connectivity, it is unlikely fans will travel to these locales in significant numbers unless they had prior plans to visit. Lodging demand will see short-term bumps around specific dates, but we do not expect any meaningful citywide impact or a sustained uplift. Fans of some countries are more inclined to travel than those of other nations. Additionally, some countries are more accessible to certain host cities than others and some countries’ fans have more disposable income to travel than others. As such, the composition of the member nations in each host city during group play and the subsequent tournament rounds will further drive the potential impact across each host city.

Adding to the uncertainty is the current U.S. political climate, which may have a dampening effect on international travel demand. Current policies and rhetoric surrounding visas, border control and general receptiveness to foreign visitors are all being closely watched, particularly by fans traveling from outside North America. If the perception of the U.S. as a welcoming destination remains strained, that may impact both attendance levels and length of stay, particularly in non-gateway markets.

Ultimately, the 2026 World Cup is best understood as not a single tourism event, but as 16 distinct ones: each city hosting its own version of the tournament with unique outcomes. Markets with global appeal and strong tourism infrastructure are poised to benefit the most, while others may experience only brief surges in activity tied to match days and media presence.

Story contributed by Ryan Meliker, president and co-founder of Lodging Analytics Research & Consulting (LARC), and Michelle Li, a lodging analyst at LARC.