STR Global is forecasting positive revenue per available room (RevPAR) growth across four key Asian markets in 2012.

Supply is expected to grow between 1.1% and 2.5% across Beijing, Hong Kong, Singapore and Sydney, with demand predicted to increase between 1.7% and 3.8%. Following strong demand growth during 2010 of 22.8% and 2011 of 6.2%, Singapore is expected to see the metric increase at a rate less than supply during 2012. The imbalance is forecasted to lead to an occupancy decrease of 0.6% for the year.

In Beijing, occupancy growth and ADR growth of 4.5% to CNY 677.76 (US$107.31) will support RevPAR growth between 5.0% and 7.0% in 2012.

Hong Kong is predicted to see the largest supply increase, 2.5%, of the four cities, which is expected to be offset by a 3% demand increase that will drive growth in occupancy, ADR and RevPAR.

Sydney is forecasted to see the smallest supply increase, resulting in a moderate occupancy gain of 1.2% and ADR up 2.6%.

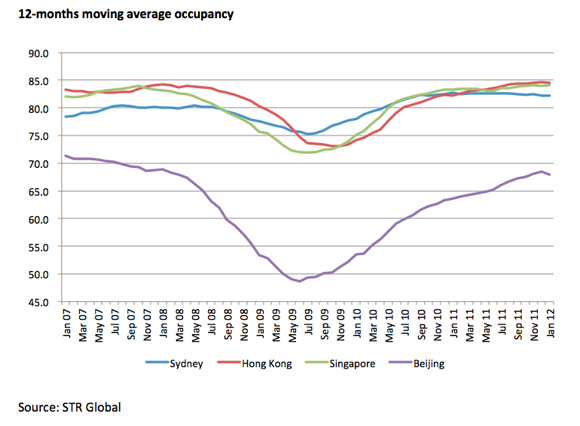

For the 12 months through January 2012, Hong Kong reached occupancy of 84.5%, followed by Singapore at 84.1%, Sydney at 82.1% and Beijing at 67.9%, where 12-month average occupancy levels were similar to the levels recorded during the pre-Olympics period in March 2008.

“Our forecast indicates that 2012 will be another positive year with demand growing in Beijing 3.8%, Hong Kong 3%, Singapore 1.7% and Sydney 2.3%. This, coupled with limited new supply, will benefit RevPAR,” said Elizabeth Randall, managing director at STR Global. “With high demand and corresponding occupancy levels, we estimate average room rates to pick up.”