Editor’s note: This is the first of a two-part series highlighting research from Trevor Ward’s W Hospitality Group on Africa’s hotel pipeline. The second part will publish on Friday.

Each year W Hospitality Group, Lagos, Nigeria, carries out a survey of the international hotel brands’ development activities in Africa. The hotel chains in the survey currently have almost 99,000 rooms operating in Africa, with around 44,300 in North Africa and 54,600 in sub-Saharan Africa.

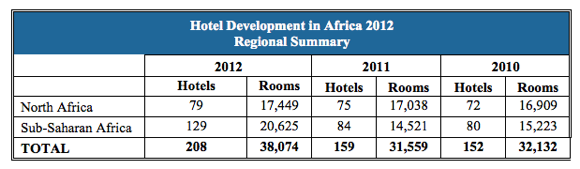

At the beginning of 2012, the international hotel chains reported a total of 208 signed deals for hotels, with just over 38,000 rooms, in their development pipelines in Africa.

Compared to the contractions in development pipelines in other parts of the world, particularly Europe and the USA, the pipeline has seen a massive increase from last year – 31% more hotels and 21% more rooms. And this is happening at a time when the chains have also been opening new hotels on the continent.

Historically, North Africa has dominated the development effort, especially in the tourism hotspots of Morocco and Egypt. The Arab Spring has led to delays in many development projects there, and the cancellation of others. The 2.4% increase in pipeline rooms in 2012 is eclipsed by the chains’ advances in sub-Saharan Africa where, after a reduction in 2011, this year sees a massive 42% increase in pipeline rooms.

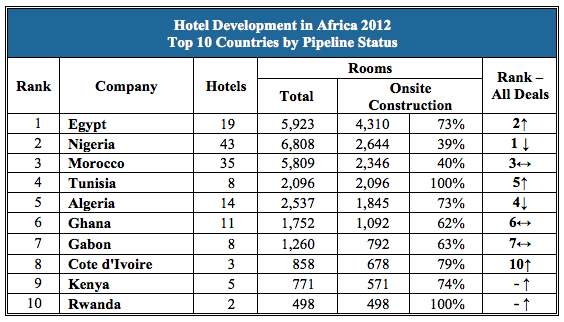

All of the five North African countries feature in the top ten destinations for branded hotel developments – driven either by the well-established tourism industries in the likes of Morocco, Tunisia and Egypt, or by the opening up of the oil-based economies in Algeria and Libya. Over half of Accor’s pipeline is in Morocco and Algeria, underlining their commitment to North Africa. But while they have many signed deals, many contributors have listed the opening dates of their planned hotels in North Africa as “not known”, facing delays or, in some cases, cancellation because of the uncertainty in the region.

Historically, the focus of the international chains has been on North Africa, but even before the Arab Spring, they were eying sub-Saharan Africa, and the results are beginning to show. Finance for projects in North Africa used to be more easily sourced, with foreign investors perceiving less risk there than in the more volatile sub-Saharan Africa. But times have definitely changed, and countries south of the Sahara are seeing much more activity.

Two countries new to the Top 10 are Gabon and Cote d’Ivoire, both emerging nations with massive resources. As well as the Radisson Blu deal in Libreville, Marriott have signed for a new build Marriott hotel with a Marriott Executive Apartments, to be built by the same developer who is building a Marriott in Cotonou, Benin. In Abidjan, Accor are taking over the Hotel Ivoire, a former InterContinental hotel, and will brand it as a Sofitel.

Nigeria and Egypt change places, with most of the Nigerian deals signed only recently, so there is an interval before they can appear on the “under construction” listing. But there are still more rooms under construction in Nigeria than there are in Morocco, which has a far larger tourism industry. Libya drops off the list, as several of the signed deals are unable to proceed. Rwanda and Kenya both join the list; a Radisson Blu and a Marriott are under construction in Kigali, and Nairobi is seeing more activity than it has for many years, with Best Western, Radisson Blu, Park Inn and Three Cities-branded hotels all under construction, and a 200-room Lansmore Hotel, Lonrho’s new brand, on the drawing board.

Equatorial Guinea, one of Africa’s smallest countries, had 4 hotels under construction last year, three by Accor, including a Sofitel (their second in the city) and an Ibis in Malabo on Bioko Island, and another Ibis in mainland Bata and a Hilton close to Malabo airport. All have opened, showing that signed deals do become reality, even in “difficult” places. South Africa, in 9th position (down from 7th last year) in terms of signed deals, drops out of the rankings, partly due to the dominance of domestic chains (who are not included in this survey of international chains), and also because of the building boom that preceded the FIFA World Cup in 2010.

On average, the global hotel brands have less than 2% of their total rooms in sub-Saharan Africa, and with rapid expansion of their existing and upcoming hotels in China, India and other developing and developed countries, this percentage could drop further. But the rewards in Africa are high, and with economic growth rates in many countries of 7% and above, it is regarded by many as the most profitable place to do business — just oftentimes slower than normal.