As a hospitality consultant, my career has taken me across the globe, but it started in the Middle East, where, in the early stages, I traveled extensively to Saudi Arabia, a country that is now reshaping itself to become more welcoming and more open to travel and the attendant logistics and real estate that come with it.

Today, Riyadh is vastly different than how I remember it. So much so that I have a hard time comprehending the drastic changes since my first visit years ago. This has not happened haphazardly, rather by meticulous and very expensive design. This is the vision of Saudi Arabia: to mimic the success of the UAE and move away from an almost complete reliance on fossil fuels toward a more diversified economy that promotes travel and hospitality. In fact, in 2016, the Kingdom announced a formal plan to do so called Saudi Vision 2030.

Leisure is heavily promoted and world-class facilities to support it are rising fast. Companies wishing to do business in the Kingdom need to have a regional-level permanent legal entity. Construction is booming with the addition of major sporting events, such as Formula 1, Formula E and its high-level football league, to name a few.

What, then, does all this development mean for hotel performance in Saudi Arabia? Well, it hasn’t radically impacted hotel performance. Year-to-June GOP levels of the two biggest cities in the Kingdom, Jeddah and Riyadh, are in line with the same time a year ago, with Riyadh up 3 percentage points versus the same time a year ago. Meanwhile, though Dubai has plateaued, it is outperforming both, while Cairo is almost at a 60% margin due primarily to a drastically lower cost of operation and a healthy revenue stream.

Saudi Arabia numbers are still quite strong and constantly growing, with performance blunted by the massive growth in new hotel supply, as well as the high cost of labor in the Kingdom as it drives out higher quality expat workers and focuses on increasing the percentages of local hires, which, in most cases, is more expensive than expatriates.

Back to Life

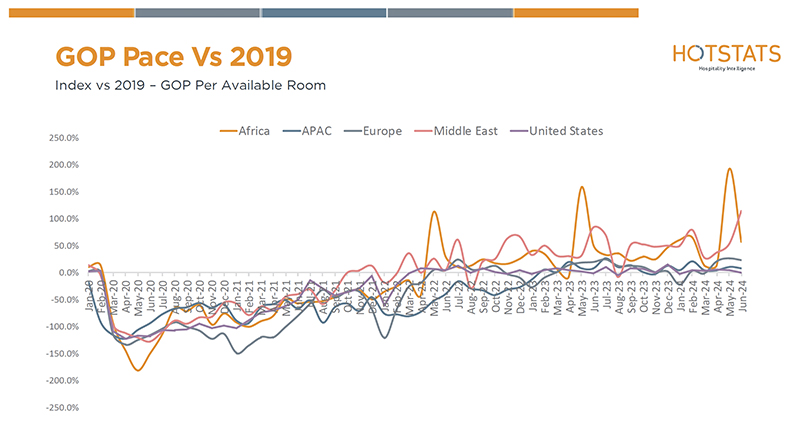

The Middle East was the first region in the world to return to its pre-COVID, hotel-performance levels. This happened in September 2021, eight months prior to anyone else. Then, around May/June 2022, the rest of the world began to catch up, all except for the Asia-Pacific region, which took almost a year after that to begin its path of positive recovery.

Meanwhile, the ebb and flow that characterizes Africa is noteworthy: huge highs and major dips over the past 24 months, with the biggest peak appearing in May at 200% GOP growth over January 2020, well outperforming its nearest competitor, the Middle East. However, characteristic of its fluid nature, it dropped back substantially in June.

Where, then, is this GOP growth coming from in Africa? Look at payroll, a major cost factor, but Egypt, the largest market in the continent, showed just 13.7% payroll cost in 2024 YTD June, while South Africa recorded a well-managed 22%.

Drilling down deeper into rooms division profitability, Egypt is soaring at 88%. The picture is clearer, but still doesn’t fully explain the extraordinary GOP growth across Africa. If it’s not South Africa, Egypt or Morocco, who is it? Sub-Saharan Africa, that’s who, where a combination of low energy prices, low cost of labor, small supply additions, strong business travel demand and government-led conferences are hiking up the numbers and causing the wide curves in the data. It’s quite extraordinary.

Takeaways

The past 24 months have been marked by a deluge of news about the Middle East; specifically, mega projects in Saudi Arabia with eye-watering budgets, over-the-top new hotels and even casinos rising out of the sands in the UAE. All headline-worthy news, but, while all of this was going on, Africa was hardly talked about, maybe a small four-star business hotel opening every few months, but that’s it.

However, as you can see from the numbers, it is by far the best-performing region in the world when it comes to profit margins and, over the next few years, it certainly will be on the radar of hospitality investors.

Story contributed by Tareq Bagaeen, a sales trainer and senior consultant with data benchmarking firm HotStats.