Hotel profits have steadied worldwide, but for the Americas, the story is more complicated: Growth is slowing, costs are climbing, and margins are feeling the squeeze.

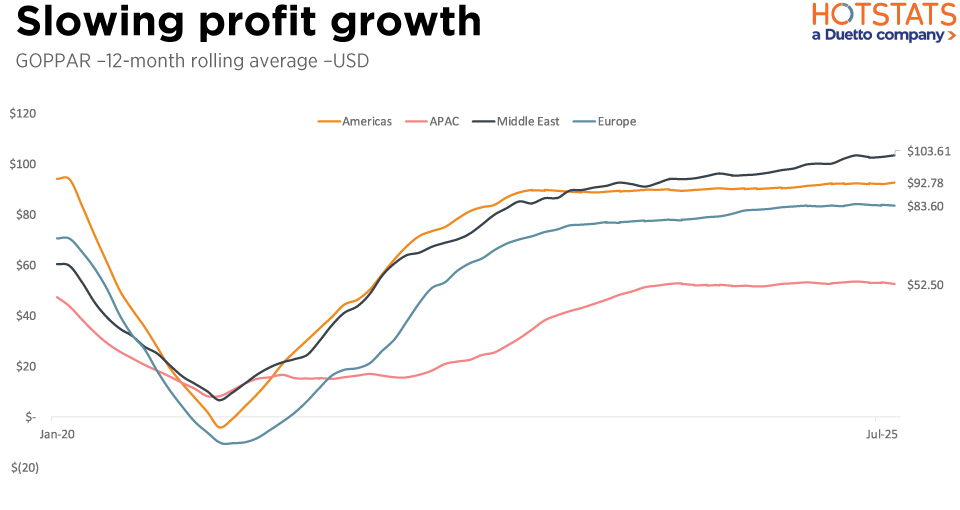

HotStats data show that while the industry rebounded sharply from the pandemic lows of 2020, the latest figures reveal a clear plateau.

The Middle East currently leads the world in hotel gross operating profit per available room (GOPPAR) at $103.61, followed by the Americas at $92.78, Europe at $83.60 and Asia-Pacific trailing at $52.50, underscoring the uneven nature of the recovery. Although the Americas ranks second in profitability, it remains the only region yet to fully recover to 2019 levels, with growth showing clear signs of slowing.

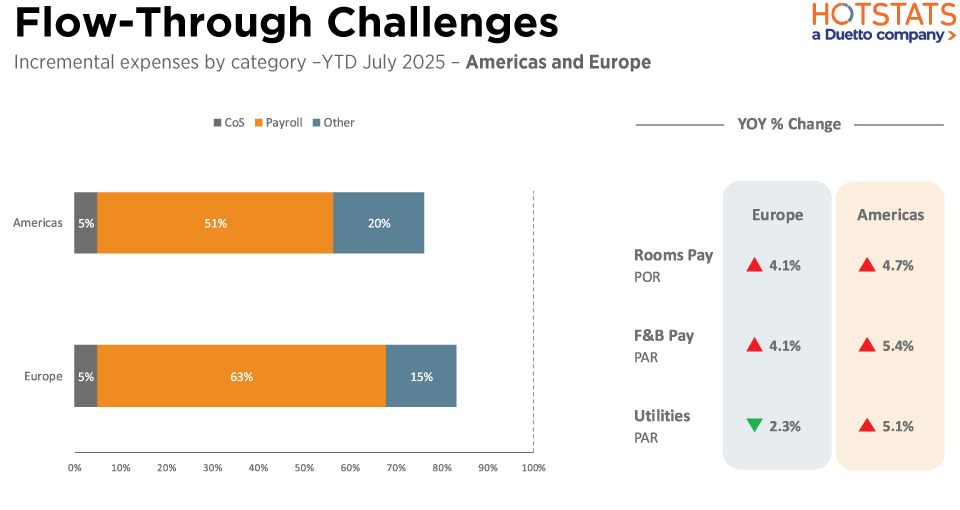

Looking at year-to-date performance as of August 2025, both TRevPAR and GOPPAR increased across all regions and, in many cases, profitability outpaced revenue growth. The Americas, however, tell a different story, one of slowing growth and mounting costs. While total revenue rose 3.2%, GOPPAR increased by only 1.9%, with profit margins slipping 0.4 points.

The region’s year-to-date flow-through sits at 20%, meaning that for every additional dollar of revenue, only 20 cents translates into profit. Of the remaining 80 cents in expenses, 6% went to cost of sales, 53% to payroll and 21% to other expenses, including a notable 4.8% increase in utility costs.

SEGMENT TALK

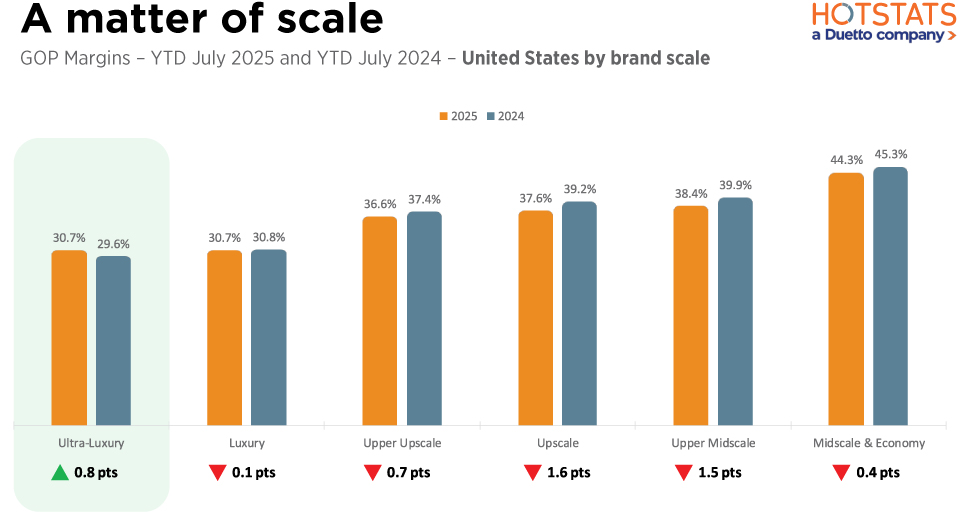

A closer look at U.S. brand scales shows that most are trailing their YTD 2024 performance. The exceptions are ultra-luxury hotels (up 1.1 points in GOP margin) and luxury hotels (down just 0.1 points). These segments benefit from multiple revenue streams and facilities that attract both overnight guests and local spend.

Across the board, payroll continues to climb while occupancy slows, squeezing margins further. Even ultra luxury hotels, which reported a 7.5% increase in TRevPAR, saw payroll per available room grow 8.3%, eroding profitability gains. Hotels with smaller opportunities for ancillary revenue, such as midscale properties, are struggling the most. With limited additional revenue sources, they remain highly vulnerable to declining occupancy and rising labor costs.

Overall, the data show that while global profitability has leveled out, the Americas remain under pressure as rising costs outpace revenue growth, especially for lower-end brand scales. This raises a key question for hoteliers: How can operators rebalance cost structures, particularly labor, while finding new revenue streams to sustain profitability in a slowing market?

It’s one where data-led benchmarking can provide answers. By understanding how peer properties manage costs and capture revenue, operators can uncover strategies that directly improve margins.

Contributed by Bugsy Chiu & Jeannette King, HotStats.