Building high-end hotels is not easy, it’s not inexpensive, but that hasn’t stopped developers from trying, according to new data from hotel supply and data consultancy Lodging Econometrics (LE).

In the latest Hotel Construction Pipeline Trend Reports from LE, at the end of the second quarter 2023, the global hotel construction pipeline stood at 14,615 projects/2,320,832 rooms. Of those project and room counts, the luxury and upper–upscale chain scales both have record high project and room counts. Combined, these two chain scales account for 2,970 branded and unbranded projects or 20% of projects and 654,717 rooms or 28% of rooms in the global hotel construction pipeline.

Separately, both chain scales have record high project counts with luxury accounting for 1,100 projects/227,278 rooms of the global construction pipeline and upper-upscale having 1,870 projects/427,439 rooms. Year-over-year these two chain scales combined have grown 22% by projects and rooms.

There are currently 1,492 luxury and upper-upscale projects and 353,817 rooms under construction in the global pipeline. Another 584 projects/122,123 projects are scheduled to start in the next 12 months, and the early planning stage of the pipeline has 894 projects with 178,777 rooms. Each stage of the pipeline for these two chain scale segments has increased YOY.

ON LOCATION

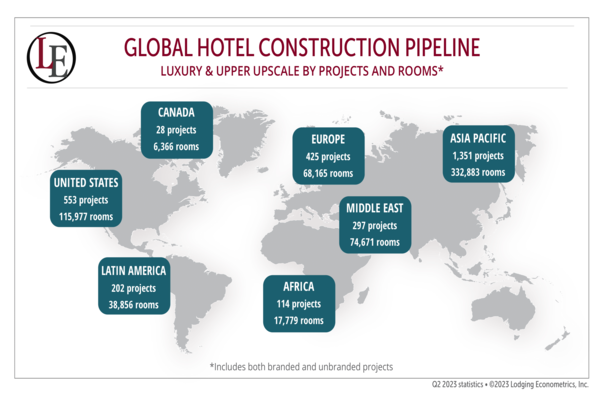

Location matters, in particular for high-end supply. At the end of Q2 2023, hotel development in the luxury and upper-upscale chain scales was largely found within the Asia-Pacific region, which currently has 1,351 projects/332,883 rooms in the pipeline. In addition, 781 of these projects, accounting for 199,114 rooms, are in the under-construction phase of the pipeline.

Over the last five years, the Asia-Pacific region has led luxury and upper-upscale hotel development, with development counts growing YOY. Trailing APAC is the U.S. with 553 luxury and upper-upscale projects in its pipeline, accounting for 115,977 rooms. Europe follows closely behind with 425 projects/68,165 rooms, and then the Middle East with 297 projects/74,671 rooms. Latin America, Africa, and Canada, in that order, round out the world with 202 projects/38,856 rooms, 114 projects/17,779 rooms and 28 projects/6,366 rooms, respectively.

Not surprisingly, the majority of the luxury and upper-upscale pipelines are in APAC cities, but they aren’t tops. The top 10 cities around the world with the most luxury and upper-upscale hotel development at the end of Q2 2023, include the Provincial region of Europe, which has 56 projects/11,984 rooms; Riyadh, which has 52 projects/10,055; Shanghai with 40 projects/10,019 rooms; Dubai with 35 projects/12,240 rooms; and Chengdu and Shenzhen, each with 31 projects/9,748 rooms and 8,105 rooms, respectively. Following these two cities are Bangkok, Hangzhou and Los Angeles, all with 26 projects. Rounding out the top 10 is London with 24 projects/3,446 rooms.

Since projects in the luxury and upper-upscale chain scales tend to be larger in scale, it is no surprise that there are 578 projects in the pipeline that are expected to have 300 or more rooms each. The largest of these projects is the upper-upscale Mangrove Tree Conghua project in Guangdong, China, which is still in the early planning phase. It will boast 4,760 rooms if it comes to fruition. This project is followed by the luxury Fontainebleau Las Vegas that is currently under construction and plans to have 3,180 rooms when it opens later this year. Other significant projects that are currently under construction include the 1,600-room, upper-upscale Gaylord Pacific Resort & Convention Center, in Chula Vista, Calif., and the Grand Westside Hotel in Manila, which will add 1,530 rooms to the supply in the Philippines.

Finally, according to LE’s forecast for new hotel openings, these two chain scales will have 505 projects/102,567 rooms open by year-end 2023. In 2024, LE is anticipating 511 luxury and upper-upscale projects to open having 105,578 rooms. And, in 2025, 568 luxury and upper-upscale projects/116,730 rooms are expected to open.

Column contributed by Bruce Ford, SVP of Lodging Econometrics.