The hotel industry is shifting from offense to defense and the goal is to protect margin.

By the end of 2025, the U.S. hotel industry had shifted decisively from post-pandemic recovery to a period defined by margin defense. What began as cautious optimism early in the year gave way to a need for recalibration as key performance indicators fell short of expectations. Demand stabilized, but expense growth, particularly labor, insurance and fixed operating standards, continued to outpace revenue gains, compressing gross operating profit (GOP) across nearly all segments. While most segments are feeling the squeeze, full-service, extended stay, and multi-F&B outlet hotels are feeling the impact more broadly.

Now, into 2026, owners can no longer rely on ADR growth alone to protect profitability. Disciplined cost governance and active asset management have become essential to preserving value. The most successful owners will treat near-term margin defense and medium-term strategic investment as complementary priorities: maintaining guest experience and brand equity while deploying targeted initiatives in labor productivity, procurement, energy efficiency, revenue-margin optimization and technology consolidation.

Margin Story 2025 — A Reset, Not a Blip

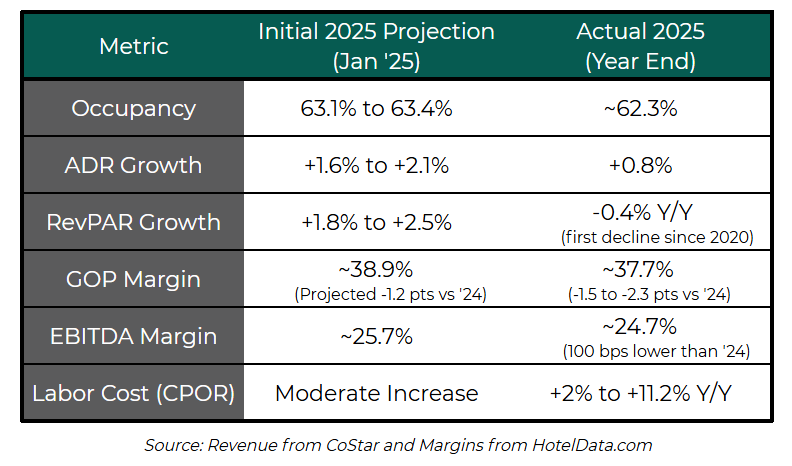

Industry expectations entering 2025 called for modest but steady growth. By yearend, the picture looked very different.

Three forces drove the gap between projections and reality:

- Macroeconomic volatility — rising interest rates, tariffs and persistent inflation.

- Demand unpredictability — shortened booking windows, with transient bookings dipping below four days.

- Policy disruptions — government shutdowns, geopolitical tensions and reduced federal travel.

HVS data confirm that GOP margins declined across all property types in 2025, with unionized hotels experiencing the sharpest erosion due to rigid staffing rules and contractual wage escalations.

What can owners do now to mitigate margin erosion?

Six high-impact cost-containment initiatives for owners to improve margins:

1. Redesign Labor Productivity Models

- Owners should challenge legacy staffing assumptions and brand standards. Key actions include:

- Crosstraining and combining roles (e.g., concierge/front desk/bell).

- Reducing supervisory layers.

- Implementing housekeeping self-check models.

- Integrating labor forecasting with booking pace through rolling forecasts.

- Investing in selective automation (kiosks, robotics, predictive maintenance).

KPIs: Labor cost %, minutes per room, overtime hours.

2. Strategic Procurement & Centralized Purchasing

- Consolidate vendors across the portfolio.

- Use reverse auctions for high-spend categories.

- Standardize specifications and implement minmax inventory controls.

- Consider GPO participation.

KPIs: CPOR reduction, shrinkage/spoilage rates.

3. Energy & Utility Optimization

- Start with an energy audit, then implement:

- EMS platforms

- LED retrofits

- HVAC zoning

- Load shifting and demand response

- Solar + storage where feasible

KPIs: kWh per occupied room, utility cost per available room.

4. Tech Stack Rationalization

- Eliminate redundant SaaS tools.

- Negotiate enterprise licenses.

- Integrate PMS, POS, RMS, CRS, and HRIS to reduce manual work.

- Use RPA for invoicing and reconciliations.

KPIs: SaaS spend per property, back-office FTE hours saved.

5. Reengineer F&B for Margin

- Simplify menus.

- Focus on high-margin items.

- Standardize purchasing.

- Enforce portion controls.

- Reduce waste and consider third-party partnerships for transient demand.

KPIs: Food cost %, average check, plate contribution margin.

6. Portfolio-Level Shared Services

- Audit centralized services charged by management companies.

- Validate allocation methodologies.

- Identify opportunities for shared services to reduce property-level FTEs.

KPIs: FTEs per property, central OPEX savings.

Margin Management Is the New Operating Mandate

The GOP squeeze of 2025 was not a temporary anomaly: it marked a structural reset in hotel operating economics. As the industry moves through 2026, ADR alone will not restore margins. Owners who actively manage labor productivity, challenge fixed cost creep and align operators around NOI outcomes will be best positioned to protect and enhance asset value.

Short-term cost containment must be paired with medium-term strategic investment to preserve guest experience, brand value, and long-term competitiveness.

Story contributed by John Paulsen and Sebastian Villa, hotelAVE.