The Middle East’s transformation into a global hospitality powerhouse is a story of vision, investment and relentless ambition. Two decades ago, Dubai presented an emerging urban landscape—marked by sand dunes and limited infrastructure. Today, it stands as a global icon of architectural innovation and hospitality leadership, boasting the world’s tallest building, expansive man-made islands and groundbreaking hotel developments that continually redefine industry standards.

Over time, Dubai has evolved from a single city center into a diversified metropolis. Financial operations cluster around Dubai International Financial Centre (DIFC), creative industries thrive in Media City and hospitality dominates across sprawling districts, offering record-breaking attractions and five-star experiences. This multi-nodal structure reinforces Dubai’s position as a magnet for international tourism and business. It has become a powerhouse global hub and hotel performance has followed suit.

Like Dubai before it, Saudi Arabia is now emerging as a formidable hospitality market. Once viewed primarily as a destination for business travel—with Riyadh home to just two modern towers—the Kingdom has undergone sweeping reforms.

Under Vision 2030, Riyadh is being recast as a destination for business, events and leisure, supported by staggering investment across infrastructure and tourism. Riyadh, the capital, had two notable modern towers—Kingdom Tower, home to a Four Seasons, and Al Faisaliah Tower with a Mandarin Oriental hotel. Other international properties existed but lacked distinction. Business was the only reason anyone visited: There were no concerts, no cinemas, no major sporting events—nothing that would draw a leisure traveler.

Things have changed. In the past eight years, Saudi Arabia has been on an accelerated path of modernization, growth and diversification away from oil. The amount of investment has been staggering: advancement in architecture, infrastructure, leisure, events, business and even in societal norms—enough to draw global attention and put real competitive pressure on Dubai.

Despite significant progress, leisure tourism in Saudi Arabia still trails Dubai. However, recent developments, such as the introduction of regulated alcohol sales in designated areas, suggest an intentional pivot to broader tourism appeal.

In the realm of regional commerce, Dubai and Riyadh are competing for corporate dominance. By 2017, many global firms, including Apple, PwC, ExxonMobil, Hilton and Marriott International, were operating regional hubs from Dubai. In response, Saudi Arabia introduced mandates requiring regional headquarters to be physically based in the Kingdom—prompting a strategic shift. An ensuing law mandated that companies must have a full regional office in the Kingdom, not just a country branch; things kept changing.

Dubai responded: Liberalizing its business laws to remain competitive, particularly in allowing foreign-owned companies to operate outside free zones, meant foreigners could set up businesses just like the locals. Competition began in earnest.

Middle East Promise & Profits

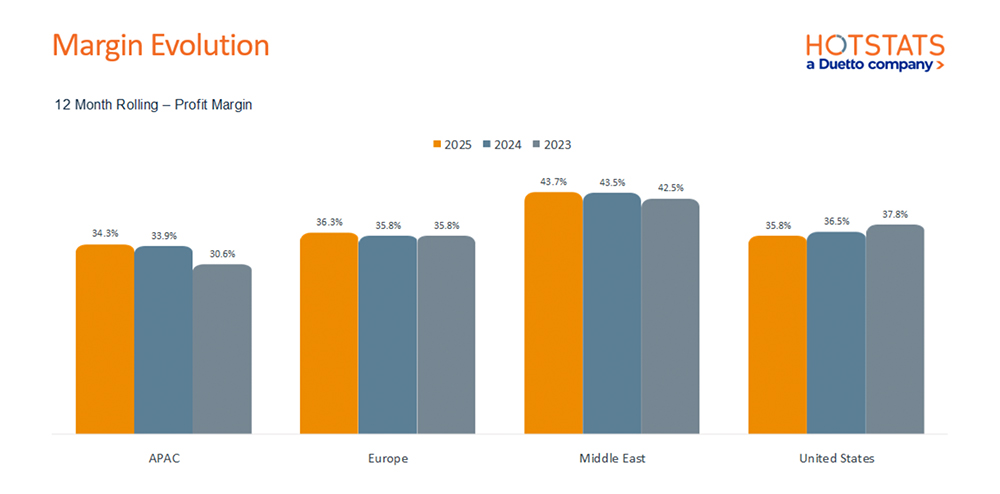

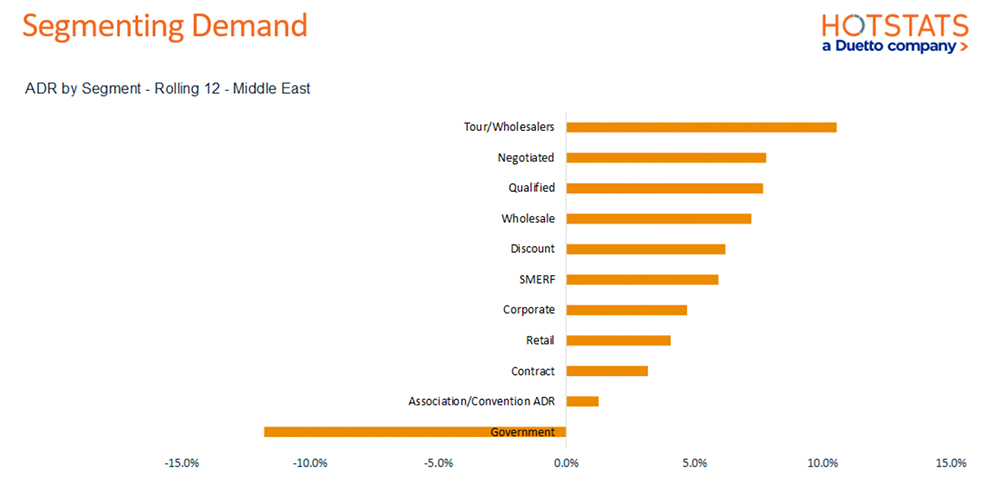

For three years running, the Middle East has been the single-most-profitable region globally and has grown marginally year on year from 2023 to 2025. Tour and wholesaler demand segments drove the highest ADR growth in the Middle East, while government-related bookings declined sharply, with ADR dropping over 12% year-over-year—underscoring a structural shift away from public sector dependence toward higher-yielding leisure and negotiated segments.

One might think that government spending is propping up the numbers artificially; it’s not. The government segment is the only one to have contracted, while all other segments, particularly leisure, have experienced consistent growth.

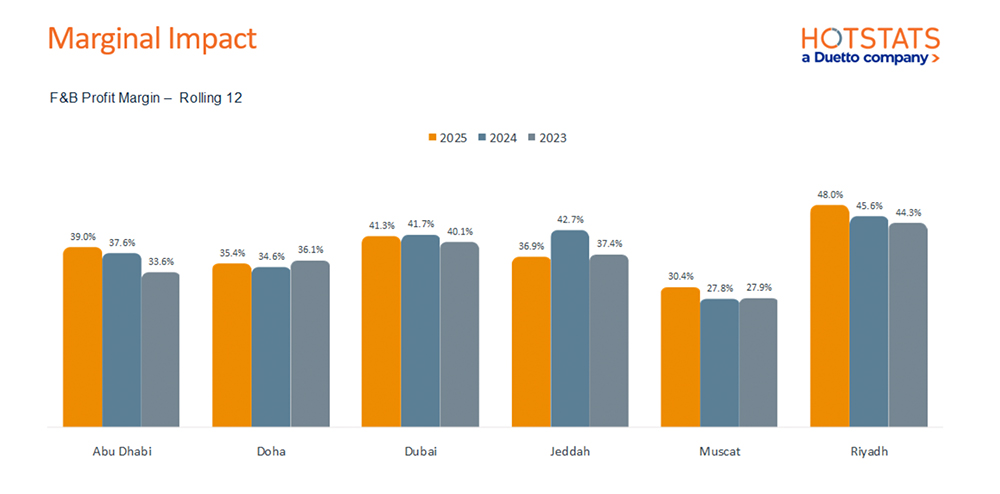

Riyadh leads the region in food & beverage profitability, reaching a 48% margin in 2025—outperforming peer markets such as Dubai (41.3%) and Jeddah (36.9%). Prices are high and costs are contained, leading to a new global performance standard in F&B profitability. This three-year upward trend highlights Riyadh’s rising commercial strength despite limitations like alcohol restrictions.

Egypt continues to operate with the region’s most efficient labor model, reporting a labor margin of just 11.5% in 2025, compared to 28.3% in Qatar and 22.3% in Saudi Arabia. These disparities reflect differing wage structures, employment policies and talent competition across markets. Today, both Saudi Arabia and the UAE are emerging as top destinations for hospitality professionals seeking long-term career growth and opportunity.

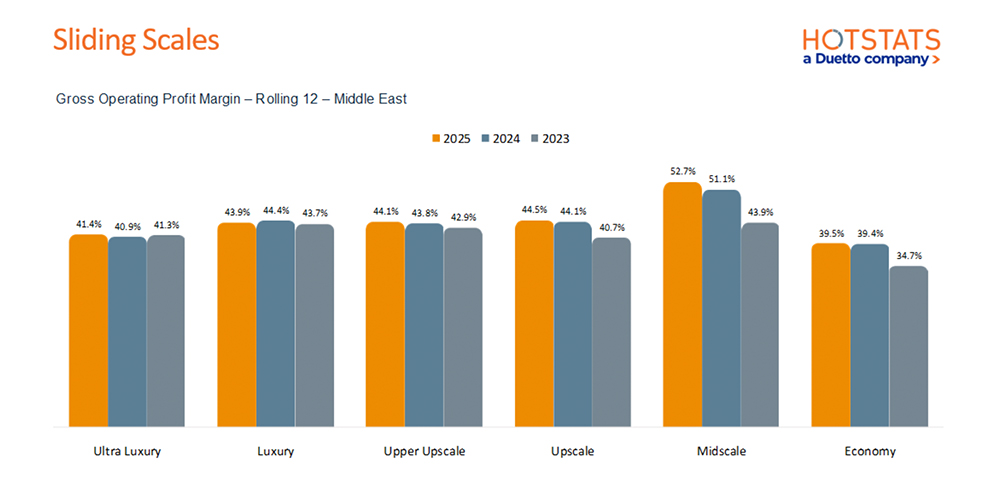

A deep dive into asset classes across the region reveals a picture that defies social media stereotypes—it’s not all about glamor and luxury. Midscale properties lead the market in terms of overall profitability and are the most lucrative and fastest-growing segment. What is impressive, though, is how consistent all others are within the range, with upscale to ultra-luxury hotels maintaining stable gross operating profit margins in the mid to low 40% range.

The region is undeniably thriving with Dubai and Riyadh leading the charge, and from all social, business, leisure and other significant indicators. Barring any major disruption, there are no signs of this momentum slowing. The Middle East has firmly established itself as the world’s leading hospitality region—and it is poised to continue advancing on this trajectory.

Story contributed by Tareq Bagaeen, a senior consultant at HotStats.