NEW YORK — Average daily rates at hotels continue to hit high watermarks and they don’t appear to be dampening demand among the traveling public. At the luxury Aman hotel in New York, where the NYU International Hospitality Industry Investment Conference was being held, rates were starting at more than $2,000 per night and that’s before any add-ons, like the omakase at Nama, which will set you back more than $200 per person.

“Through the first four months of the year, hotel demand improved 4.3 percent,” STR President Amanda Hite told a rapt audience at the conference. Indeed, according to STR, after a record year for ADR in 2022, rate is forecasted to hit $154.28 for full-year 2023.

The unquenchably optimistic Tyler Morse, CEO of MCR, predicted that ADR would be up 10% this year, calling inflation “the greatest thing to happen for the hotel industry.” (Hotels can drop and increase rates on a daily basis.)

Investors should be gung-ho on hospitality, right? Not so much—yet. Though travel is strong and could become stronger as China and other countries open up further, fears over a recession, inflation trepidation and, above all, tougher financing conditions, have leant itself to limp dealmaking.

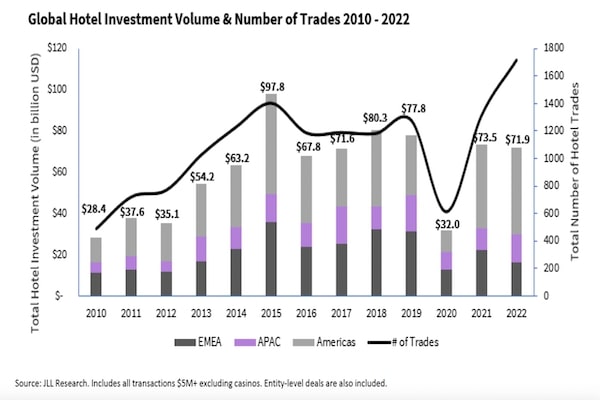

According to JLL, global hotel investment volume reached $71.9 billion in 2022, a 2% decline relative to 2021. For HOTELS, JLL Hotels & Hospitality Group’s Ophelia Makis wrote that transaction activity in Q2 2023 is expected to be subdued akin to Q1.

The displacement between hotel demand and transaction activity could continue until investors have stronger clarity or owners have reason to part with their assets. Which comes first?

“I’ve never seen capital markets so closed with the economy so strong,” said Michael Bluhm, managing director, global head of gaming and lodging, Morgan Stanley Investment Banking. “You are seeing a liquidity crisis and the ability to lend has become smaller.”

The difficult debt market is apart from what Greg Friedman, CEO of Peachtree Group, called “interest” on the buy side, “but it’s a difficult market,” he said. “It’s a hard deal market in terms of understanding valuations.”

But not for everyone. MCR acquired three hotels recently and Morse said it is buying nine more in the next 30 days. “People are getting flushed out,” he said. Translation: It is getting harder and harder to hold assets, having to deal with deferred maintenance, loan maturities and refis on the horizon.

Wrote JLL’s Makis, “The outlook for hotel investment over the medium-term is optimistic with multiple catalysts on the horizon to drive further opportunities for acquisitions, including owners feeling financial pressure from rising CapEx needs, $100 billion in impending loan maturities in 2023 alone and interest rate cap renewals.”

Morse is known for his frankness and bold statements, but his company is one of the largest owners and operators in the country for a reason: they run hotels well, he said. “Interest rates are at 9%,” he said. “If you bought at an 8 cap rate you are running negative leverage. We run the hotels better. That’s how you pay 9% interest.”

Though transactions aren’t yet percolating, the consensus among most is that they will pick up toward the back half of the year. “We are going to see an escalation in transactions,” said Mit Shah, CEO of Noble Investment Group and a part owner of the NBA’s Atlanta Hawks, alluding to the huge amount of CapEx now needed to be put into properties, especially with brands demanding it. “These hotels haven’t been touched. How do you address that? The stress will drive transactions,” he said.

Recent transactions include a majority stake in the Mandarin Oriental New York sold to India’s Reliance Industries and the $800-million sale of the JW Marriott San Antonio Hill Country Resort by BREIT to Ryman Hospitality.

Beyond CapEx spend is the amount of loan maturities coming down the pike that will spur transactions, according to Peachtree’s Friedman. A lot of groups having to refinance or recapitalize at double will be a catalyst to go sell,” he said.

In the first three months of this year there have been more than $3.7 billion in new maturity defaults with loans failing to pay off on a timely basis, the Commercial Observer wrote recently. CRED iQ, in its CRE Maturity Outlook, showed that $162 billion in securitized commercial real estate debt was scheduled to mature in 2023.

Earlier this week, Park Hotels & Resorts said it would cease payment on the loan for the 1,921-room Hilton San Francisco Union Square, the largest hotel in San Francisco by number of rooms, and the 1,024-room Parc 55, also in San Francisco.