The U.S. hotel industry is expected to see steady but modest growth in 2025, with little change from previous projections, according to the latest forecast from CoStar and Tourism Economics (TE).

For the new year, ADR and RevPAR projections remained unchanged at +1.6% and +1.8%, respectively. Occupancy is expected to rise slightly by 0.1 percentage points to 63.1%.

Although business optimism is improving, economic data has not seen a drastic change from the previous forecast, STR said.

“The stronger performance seen in Q4 was driven by one-time factors, including holiday travel compression and weather-related events and does not constitute a change in trend. Additionally, the impact of the new administration has not been factored into the forecast, as significant policy changes have yet to be implemented, and any projected effect of those changes remains unclear,” said Amanda Hite, STR president.

The forecast suggests that higher-end hotels will continue to lead industry performance.

“Economic conditions in 2025 are expected to provide a favorable backdrop for travel activity,” said Aran Ryan, director of industry studies at TE. “Unemployment is low, inflation is slowing, consumers are spending — particularly those in higher-income households — and business investment activity is solid.”

However, Ryan noted that Trump Administration trade and immigration policy priorities present downside risks, particularly to inbound travel (e.g., through trade war responses, visa impediments, charged rhetoric and general border and policy uncertainty).

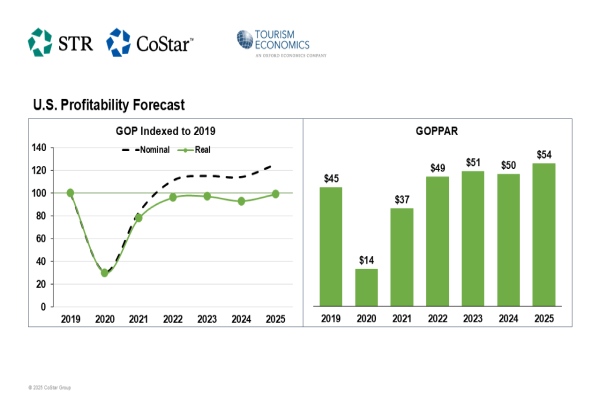

Hotels are also expected to see stabilized labor costs this year, as the industry has adjusted to workforce trends. Hite said that this will contribute to slightly better GOP margins.

“With continued growth in groups and business travel, F&B departments are expected to report some of the highest growth rates this year. Rooms and undistributed operating expense growth will moderate, though utilities departments will almost certainly see increases,” Hite said.