Hotel owners can be a fastidious lot—especially when choosing a management company to run their assets. Critical requirements must be met, but in a crowded hospitality field, saturated with brand managers and a plethora of third-party management companies, finding “the one” isn’t exactly an easy task.

For owners of hard brand hotels, the decision is mostly based on a management company’s previous experience and performance, particularly with specific brands.

NewcrestImage, a privately held family office investment firm based in Dallas with more than 3,300 hotel rooms in its portfolio looks at a management company’s geographic expertise, its experience with the hotel brand involved and its penetration index in the market under consideration. It also doesn’t hurt that NewcrestImage has a minority stake in Aimbridge Hospitality, the world’s largest third-party operator, although NewcrestImage does work with several other management companies to run its portfolio depending on the property.

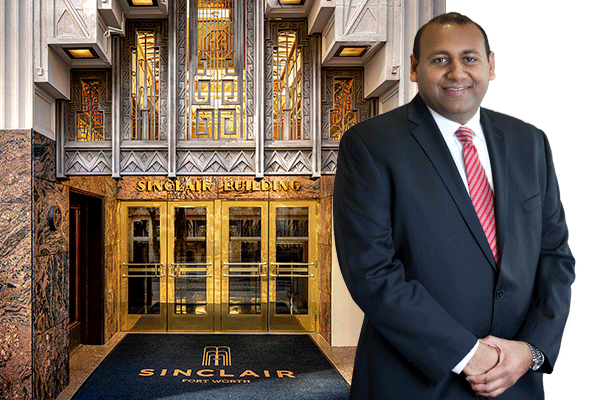

“We believe that the right combination of these factors can lead to the best growth for a property,” said Mehul Patel, managing partner and CEO of NewcrestImage.

Though finding a management company for a hard brand might seem like a “plug-and-play” solution thanks to the detailed and rigid SOPs that often are associated, finding a management company for an independent or boutique hotel may require a deeper search.

“Many management companies can manage hard brands, especially select service,” said Michael Cady, chief marketing officer of Charlestowne Hotels, a management company based in South Carolina. “But very few know how to operate full-service, independent hotels.”

Charlestowne Hotels has kept its focus on independent and soft-brand hotels, because operating these types of properties is a niche skill that they’ve honed for several years. It’s an area where Charlestowne is hitting its stride.

“The Marriotts and Hiltons of the world are really starting to get dialed in on how soft brands differ from their traditional historical brands,” Cady said. “And they’re wanting independent-minded hotel management companies to help drive that soft-brand uniqueness and creativity whether that be with food and beverage options, uniform decisions, employee training, design or marketing.”

THE EXTRA MILE

Phil Hospod, the founder and CEO of Dovetail + Co, a small but growing collection of boutique hotels, prioritizes experience and financial benchmarks when seeking out management companies, but also a willingness to build on a hotel’s personality and identity within its location.

“At Dovetail, we like to come up with the entire sort of vision and dream,” Hospod said. “But then we realize and recognize—and appreciate—the importance of turning that dream into reality and having the right operating partner who can take it all the way and, ideally, beyond what was initially concepted.”

Dovetail selected Springboard Hospitality for its Wayfinder Hotel in Waikiki, largely for Springboard’s previous work in Hawaii (formerly as a part of Outrigger Hotels) and with independent hotels. “It’s a local business,” Hospod said of the hotel, “and there’s something kind of valuable to be said about regional knowledge and presence.” Case in point, Springboard has an office across the canal in Waikiki from The Wayfinder.

SKIN IN THE GAME

Aside from ticking the performance, location and experience checkboxes, owners can also seek out management companies who are willing to invest in the asset in exchange for a contract. Having this so-called “key money” can give the owner confidence that the management company will work to keep the asset healthy because there’s a vested interest in it. Although, this arrangement can be tricky if the partnership sours and backing out isn’t as easy as terminating a contract.

Given all the recent mergers and acquisitions that have happened amongst management companies, some owners are cautious about what the reorganizations will mean for their properties.

NewcrestImage’s Patel lamented that the choices are limited, while Cady cautioned that the shuffle can take away from the day-to-day focus on the property.

Hospod pointed out that the management business benefits from scale because it creates more efficiencies. “But as you develop more scale, the risk is that you lose what made you special in the first place,” he said. For now, he’s watching the long-term picture, examining how a management company with a bigger platform and more resources will be beneficial for his company as it grows its portfolio.

LET’S BE FRIENDS

There is a litany of factors an owner will consider to select its asset operator, but when it comes down to it, the ultimate deciding factor is much simpler: do I like them? There is the ongoing relationship to think about. Are both parties aligned on performance? On vision? On decision-making? And can they grow together?

Aimbridge Hospitality works with more than 300 different hotel owners, meaning it has fine-tuned the relationship aspect of its business. It has to.

“When somebody is trusting us to manage their assets, they are looking for an agreed level of performance, an execution of operational excellence and continuous improvement,” said Mark Tamis, president of global operations for Aimbridge Hospitality. “And so long as we’re checking all of those boxes, when something doesn’t go right, that partner or owner trusts that we are going to make it right.”

Despite the fears of some owners about consolidation within the third-party space, Tamis believes the strength of a bigger company, such as Aimbridge, will only strengthen the relationships between owners and management companies.

“Whether that owner has three hotels or a couple hundred hotels, when you’re part of a division that has a divisional president, who’s really focused on their assets on a daily basis and they have real people with real names that they’re on the phone with, that they’re visiting properties with, that they’re in touch with, that’s what ultimately makes it a success and makes for a mutually beneficial relationship.”

Story contributed by Juliana Shallcross.