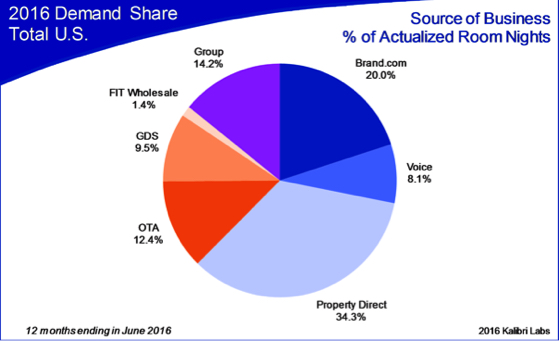

The proportion of hotel rooms being booked through digital channels, including brand.com, GDS and OTAs, is increasing ever year. This proportion, on a room night basis, over the past two years alone, has increased from 35% to 42% of all room nights booked. This growth in digital channels has come along with a distinct decline in room nights booked directly at the property as walk-ins or direct calls (aka “property direct”).

Property direct bookings have dropped from nearly 40% of all room nights booked in 2014, to 34% in 2016. As bookings that transact directly at the property generally bring the highest profit margin, and lowest cost of customer acquisition, these room nights that have shifted to other digital channels now carry higher costs of acquisition.

Hoteliers will need to ask themselves several questions going forward to get an idea of the impact of these shifts on their individual properties. For the guests who used to call directly or drive in, how are these guests now booking? Are they going to brand.com or booking through a third-party? What actions can be taken to drive consumers who may previously have booked directly at the property to book on higher profit margin brand.com or other direct channels?

Many hotels are implementing tactics to address this shift. These include front desk employee programs focused on enrolling walk-in and other guests into loyalty programs. Other hotels are focusing on changing guest behavior by offering third-party booking guests some incentive to book their next stay directly with the hotel or through brand.com. On the digital front, many hotels are working on channel optimization – such as shifting travelers from a higher cost OTA (like the Opaque model) to a lower cost OTA (like Expedia/merchant model or Booking.com/retail model), which can make a big difference to a hotel’s Net Revenue Capture.*

Hotels are also considering whether taking more business through a metasearch site like TripAdvisor or Kayak may prove more profitable than getting it through OTA channels with higher commission rates.

FULLY, 51 million room nights moved elsewhere from the Property direct channel over the past three years. The shifts the industry is seeing in this area put an additional US$6.2 billion-plus yearly in guest paid revenue into digital channels, be it directly through brand.com or indirectly through OTAs or GDS. Each hotel needs to assess the impact of this change on their business and what actions they can take to ensure as many of the shifting room nights as possible move to the higher profit margin direct channels.

* Net Revenue Capture: The percentage of guest paid revenue hotels retain after customer acquisition costs.

Contributed by Mark Carrier, Kalibri Labs, Rockville, Maryland