With an unsurprising, pandemic-related slow-down in the number of new hotels deals getting done in Africa, especially in major markets such as Ethiopia, Nigeria and South Africa, W Hospitality Group reports that as of Q1 2022 hotel development activity in 42 of 54 African countries reached approximately 80,300 rooms across 447 hotels.

Surprisingly, according to W Hospitality’s Managing Director Trevor Ward, most of the investment is going into upscale, upper upscale and luxury hotels, when there is very strong demand across Africa for quality branded budget and midscale hotels.

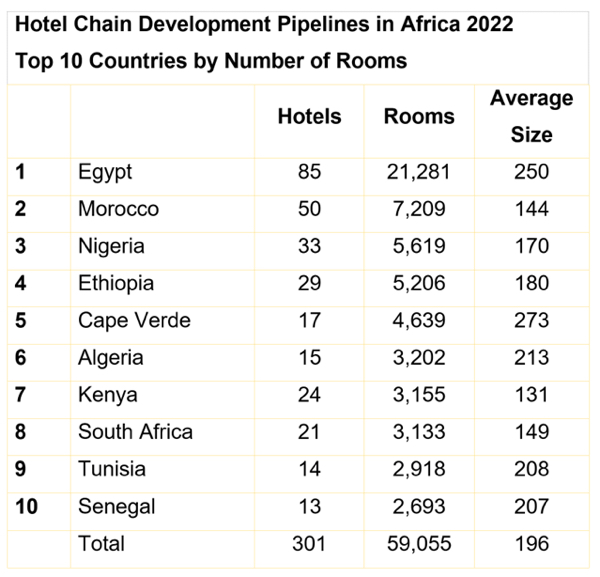

In its annual report done in association with the upcoming November Africa Hospitality Investment Forum, W Hospitality data reveals that Morocco and Egypt have the most rooms under construction with 5,577 and 6,142 rooms respectively. They are followed by: Ethiopia, 3,871; Cape Verde, 3,016; Nigeria, 2,544; Kenya, 2,450; Algeria, 2,337; Tunisia, 2,280; South Africa, 1,948 and Senegal, 1,919.

In Tunisia, Kenya and Morocco, over three-quarters of the pipeline is “onsite,” whereas in Egypt, 71% is just at the planning stage, reflecting its relatively “young” pipeline (a lot signed in the last three years). While Nigeria has 45% onsite, eight of the 15 hotels (with half of the total rooms) that have started construction have stalled with the sites closed.

Egypt takes center stage for rooms being planned as well as those under construction. with over 21,000 rooms in 85 hotels in development, up 20% year over year. It has almost three times the number of new rooms planned as Morocco, and almost four times Nigeria, which were development leaders for many years.

With continued signing activity (20 hotels with about 5,250 rooms last year), Egypt now accounts for over 25% of the African hotel development pipeline. Morocco has 7,209 rooms in development, spread across 50 new hotels; Nigeria has 5,619 rooms in 33 hotels, Ethiopia has 5,206 rooms spread across 29 hotels; and Cape Verde has 4,639 rooms in 17 hotels. The next five places are taken by Algeria, 3,202 rooms, Kenya, 3,155 rooms, South Africa, 3,133 rooms Tunisia, 2,918 rooms, and Senegal 2,693 rooms.

Notably, four out of the five North African countries are in the top 10; and the top 10 countries represent 67% of the total hotels, and 74% of the rooms, in the survey.

While Africa’s hotel development pipeline is at its strongest ever, 80,291 rooms being planned or constructed, the top-line number masks a reduction in Sub-Saharan Africa, where there has been a greater amount of hotel investment in recent years. Of the six sub-Saharan countries in the top 10, only Cape Verde has seen an increase in planned rooms, 33%, while the “power houses,” Nigeria, Ethiopia, Kenya and South Africa have between them seen a decline of 29%; Nigeria is down 41%. There are three main reasons for the reduction: fewer new opportunities in the region; opening of some 2,700 rooms in 15 hotels last year, and a pipeline “cleansing” which the hotel chains do periodically to remove various projects which are unlikely to go ahead, according to W Hospitality Group.

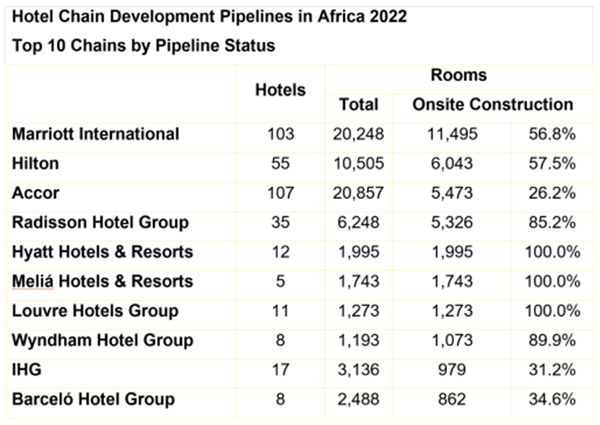

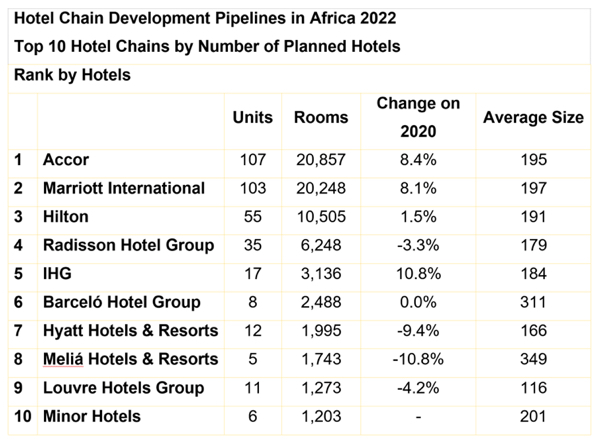

Looking at the development activity of the hotel chains, both Accor and Marriott are nearly as dominant as Egypt and Morocco, each representing just over 25% of the entire pipeline. Accor has 20,857 rooms in development, spread over 107 properties; Marriott has 20,248 rooms spread over 103 properties. Hilton has around half as many rooms, 10,505 in 55 hotels. Radisson follows with 6,248 rooms in 35 hotels. The next brands in line include IHG with 3,136 rooms; Barceló with 2,488 rooms; Hyatt with 1,995 rooms; Meliá with 1,743 rooms; Louvre with 1,273 rooms; and Minor with 1,203 rooms.

W Hospitality added that IHG merits attention, as well, due to its growth of over 10%. It signed a deal for four Indigo-branded hotels in Egypt with 650 rooms, as well as a 300-room InterContinental hotel in Cairo’s New Capital.

The top ten combined have 82% of all the rooms under construction in Africa, and the top four account for fully 66% of the total, up from 58% last year.

Also worth of note, Accor has only 26% of its pipeline onsite, whereas Marriott and Hilton have around 57% and Radisson 85%.

Ward added that while the chains anticipate that 200 new hotels are expected to open this year and next, their expectations can sometimes be over-optimistic and more so recently due to pandemic-related challenges.