The European hotel market approached pre-pandemic levels of revenue per available room (RevPAR) entering 2023 driven by strong leisure demand and soaring room rates that helped offset the impacts of inflation.

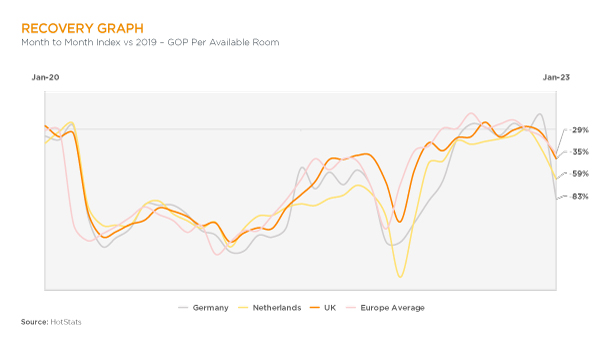

Although a dip in January is not unusual for the market, gross operating profit per available room (GOPPAR) in the first month of the year fell 29% compared to 2019, according to data from benchmarking firm HotStats. Germany

and the Netherlands, in particular, fell 83% and 59%, respectively, while the UK saw a decrease of 35%.

“In one month, we went from being recovered, as we had been for a good six-month period, to 29% down on the same time in 2019, which is a real indicator of what could happen if the rate doesn’t continue to grow or at least stabilize where it is now. If it falls off, it’s going to impact the bottom line,” said HotStats COO Michael Grove.

head of hotels, Europe at CBRE.

CBRE’s “2023 Global Hotels Outlook” indicated that occupancy growth could be muted by a recession; however, it predicted that relaxed travel restrictions in China will boost demand across Europe and an increase in business travel should balance out any potential leisure slowdown. Leisure continues to lead the recovery, making up 21% of hotel occupancies in the UK. Meanwhile, meetings and events are “getting back to their natural cadence,” said

Kenneth Hatton, managing director, head of hotels, Europe at CBRE.

“Wary of the economic outlook, you will see travel budgets somewhat being managed,” he said. “On the other hand, the need for teams to get back together seems more pressing than ever. Fewer days in the office means there’s a need to make sure that the culture of that company or group is copper fastened through in-person time.”

Despite inflationary pressures hitting purse strings, it’s still expected to be a strong summer, particularly for European resorts.

The Canary and Balearic Islands, for instance, saw profitability up 18% last year compared to 2019 and a margin increase of 1.7 percentage points, despite increasing labor and utility costs. However, the latter is hitting hotel margins across Europe, with energy costs creeping to more than 10% of hotels’ total revenue, impacted by the war in Ukraine.

PROFIT PRESSURE

GOP margin for the rolling six months to January dropped by 10.4 percentage points in Berlin compared to the same period in 2020, while Dublin and Paris increased by 4.3 and 8.3 percentage points, respectively. Despite utility costs almost doubling, Parisian hotels’ rate growth and reduced labor costs have enabled properties in the French capital to increase margin. Especially strong performance is expected for France this year as the host country of the Rugby World Cup.

However, the differences in GOP margin are not equally spread. In the UK, there was only a 1 percentage point drop off at the luxury and midscale and economy ends for the same six-month period compared to 2020, while midscale and upper midscale saw a fall of 5 percentage points.

“The high end and the real low end have been the most protected,” said Grove. “Midscale and economy hotels run very efficiently, very lean, have fewer operational pressures to consider, and at the high end they’ve been able to charge high enough rates to offset these costs.”

Added Hatton: “The pricing power in the luxury segment allows you to capture and outpace inflation. In upscale and

midscale, you struggle to do that because of competition.”

He said that hotels will need to deliver value for money to continue charging high rates. “What you’ll see is true luxury and those who are delivering true value really stepping away from the rest of the market because they’re actually delivering an experience that people are willing to pay for,” he said.

Meanwhile, across the continent, spa and leisure revenues were up by 29% and golf by 31% last year compared to 2019; however, outlet revenues were only up 3% per occupied room, with food and beverage profitability a “huge concern,” said Grove. At the same time, record cancellation levels across Europe are translating into highly profitable revenue, up 49%.

DEALMAKING

When it comes to hotel transactions, although volumes are down—€16.1 billion in 2022 following €17 billion in 2021 and €27 billion compared to 2019—Hatton said this was due to the cost to finance and the volatility of the interest rate market.

“You had this standoff between the folks whose cost of debt had gone up and this increasing performance. That meant you struggled to get people to the middle ground of doing a transaction because there was no meeting of minds as to where true value lay,” he said.

Moving into 2023, regulatory authorities’ interventions appear to have stabilized the banking sector and CBRE expects that while costlier debt and an economic slowdown will limit hotel investment activity and mean lower yields in the first half of the year, some level of recovery is expected later in the year.

“Wherever you are, it all looks like it’s coming back down into more manageable territory, which means that base rates and, therefore, the cost of debt are expected to come down,” said Hatton. He predicted the “simpler” deals are the ones that will make it over the line in 2023.

“If you look at the deals that have been done, they’ve been done by folks who are taking a longer-term view; they are long-term strategic investors,” he said. “They know there will be financing out there at a certain point in time that will be much more accretive to their deal than doing it right now. We expect those types of investors to continue to be there, but also there will be increasing interest from the rest of the investors as debt costs stabilize.”

Examples of recent activity by such investors in the UK have been Israel-based Fattal Group’s expansion into the luxury market through its acquisition of the 280-room Dilly hotel in London last year, estimated at around £80-£100 ($99-$124) million. More recently, the group acquired the 201-room Grand Brighton for a reported £60 ($74) million.

Meanwhile, Sweden’s Pandox bought the 232-room Queens Hotel in Leeds for £53 ($66) million in February and Jastar Capital snapped up London aparthotel Native Bankside earlier this year for more than £40 ($49) million.

Story contributed by Katherine Price.