File it under the category of not so surprising. According to CBRE, commercial real estate lending slowed in the fourth quarter of 2022, impacted by heightened market volatility amid higher interest rates.

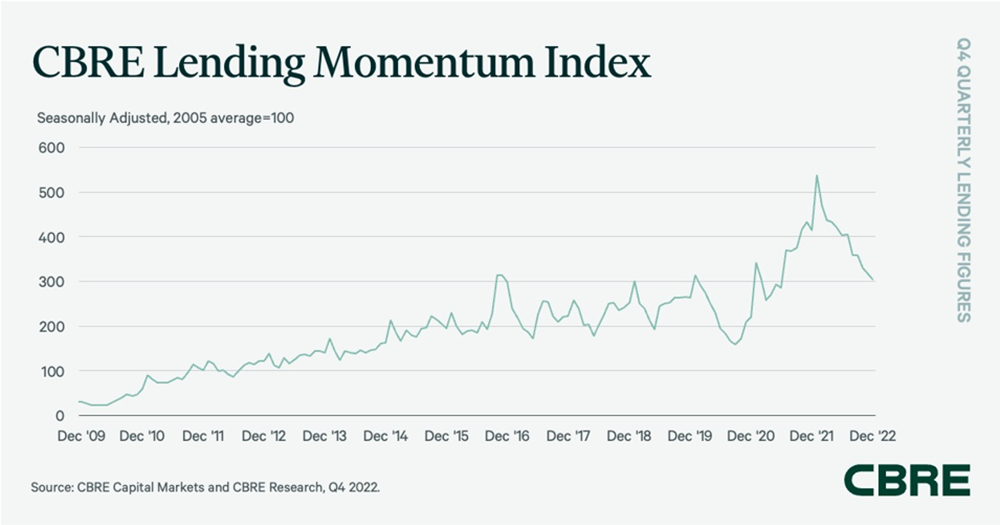

The CBRE Lending Momentum Index, which tracks the pace of CBRE-originated commercial loan closings in the U.S., declined by 15% from the third quarter of 2022 and 27% year-over-year.

“The Federal Reserve’s commitment to reduce inflation with aggressive rate hikes continues to heighten market uncertainty, as borrowing costs increase and a lack of price discovery persists. While there is plenty of debt capital available waiting to deploy, fewer borrowers are willing to transact unless they have to,” said Rachel Vinson, president of debt & structured finance, U.S. for capital markets at CBRE. “We are seeing increased activity from private capital, as well as regional and local banks. We expect demand for shorter-term, fixed-rate debt with shortened call protection to endure well into the second half of 2023.”

Not all commercial real estate, however, is built the same and, according to Bob Webster, vice chairman, president of CBRE Hotels Institutional Group, there is much optimism around hotel assets and the hospitality industry as a whole. “What is interesting is almost a decoupling between capital markets and fundamentals of lodging performance,” he said. Despite the challenging geo-political and global economic environment, the lodging industry has recorded strong YOY post-pandemic growth in RevPAR, buoyed by healthy average daily rates, especially in the leisure transient segment, and a nice bump in group demand. According to STR, RevPAR is predicted to be up 3.7% in 2023, 6.6% in 2024 and 4.7% in 2025. “Fundamentals,” Webster continued, “matter and are superior to whatever the capital market sentiment is at any given time.”

Webster has been witness to many lodging industry cycles, recounting past events that are similar to the one the industry is now part of. He said the best comparison is what happened in the summer of August 2011 when the credit rating of the U.S. was downgraded and lodging stocks proceeded to trade down as much as 40%. He recalled a deal he was working on where a buyer, so spooked, walked away from a $15-million deposit on a $440-million deal. “That’s how scary it was,” Webster said.

Having been through the ringer before, Webster is confident that history will repeat itself, meaning, he said, “The markets are going to recover,” noting improvement already in the first month of the new year, what he called “an improvement in sentiment relative to the debt markets.”

Lenders and buyers, alike, are getting itchy. Buyers buy and lenders lend. “You’ve essentially had everything on hold. Lenders don’t like sitting around not lending money and buyers don’t like sitting around not buying,” Webster said.

Webster said that, typically, in these moments when the velocity of capital stops, the velocity of transactions increases at a pretty significant rate in a short period of time. Webster alluded to 2021 as a prime example. Hotel transaction volume that year increased by 132% from 2020 to reach $66.8 billion, which was 12% below the investment volume in 2019, according to JLL data.

Debt for new development is still iffier than debt for acquisitions. Much of the restrain for the former is a function of less participants due to the higher cost of debt. “Anytime there is a constrained number of participants, the cost to transact goes up,” Webster said—a simple supply and demand interaction. “You have more development in the pipeline than you have lenders to lend. “We are looking at supply growing at roughly half of the 20-year average,” he added, calling it around 0.9%.

In this environment, where the supply of product against the demand for that product is imbalanced (which is where it has been for the last year), there is a flight to quality. “Dynamic lenders,” Webster said, “who are lending to new development have the pick of the litter.”

Webster is less enthusiastic over the prospects of new-development lending compared to acquisition lending, calling it a tale of two cities, to borrow a Dickens line. He said that those putting out debt for ground-up construction are the investment banks, but with recourse, a smattering of insurance companies and debt funds, but adding that will likely begin improving in the second half of 2023.

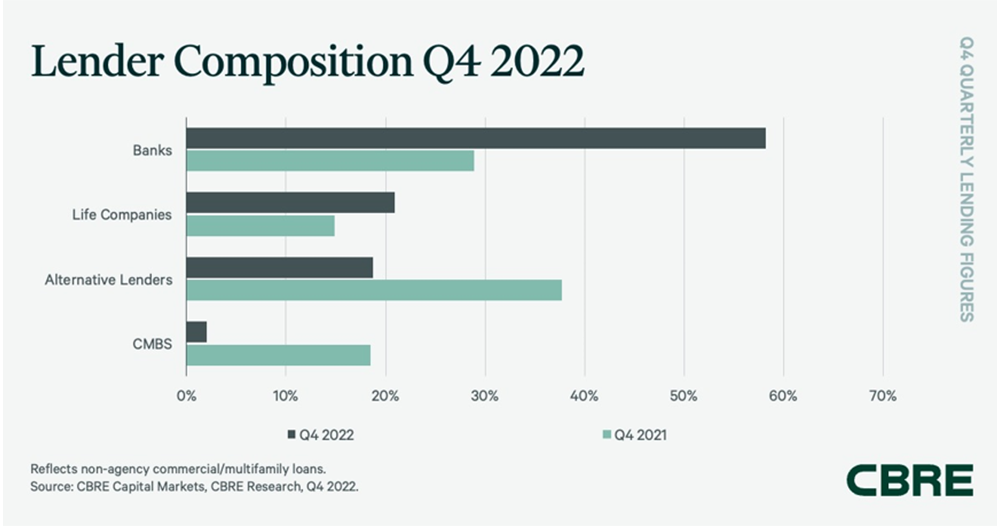

According to the CBRE report, on all commercial real estate, banks had the largest share of CBRE’s non-agency loan closings for the third consecutive quarter at 58.3%—up from 46.4% in Q3 2022. More than 80% of bank loans were floating rate. Construction loans accounted for 37% of total bank lending volume, followed by 36% for refinancing and 27% for acquisitions.

Higher mortgage rates and loan constants were the key feature of loan underwriting criteria in Q4 2022. Underwritten debt yields and cap rates on closed loans inched up in Q4 2022. Meanwhile, the average loan-to-value (LTV) ratio increased by 0.3 percentage points from the previous quarter. The percentage of loans carrying interest-only terms remained high, increasing to 72.6% in Q4 2022.