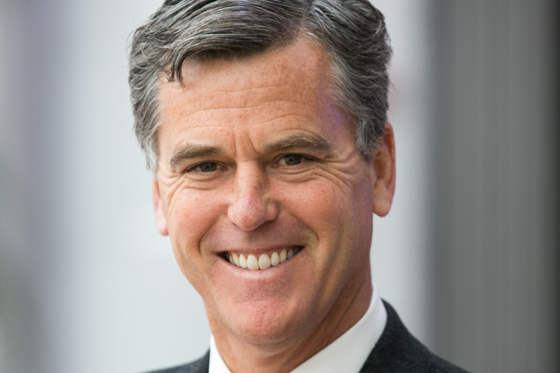

Across three investment cycles starting in the mid-1990s, John Rutledge estimates he and his team at Oxford Capital Group in Chicago have acquired, developed, repositioned, created value and harvested the returns on about 13,000 hotel rooms across the United States.

“We think of ourselves as an agile sponsor, a savvy operator (through its Oxford Hotels & Resorts management company), a disciplined investor, a creative developer and a sophisticated financier,” says the founder, president and CEO of both the investment firm and hotel company. “We try to merge all of those things and sit at the nexus of high ethical standards. We are very entrepreneurial, creative, dynamic and energetic. But we are also very institutional in terms of how we underwrite things, and are very data-driven and analytical. We like urban large-scale acquisitions, development and redevelopments.”

The group was initially founded as a platform to take advantage of what he and a partner felt was a compelling secular arbitrage opportunity resulting from the dramatic overbuilding in the nation’s property markets, particularly the lodging sector, in the early to mid-’90s. Having been involved in approximately US$3 billion of real estate and private-equity investments, including more than 2,000 senior housing units, Rutledge has great perspective on where the hotel industry sits today from both a development and operations standpoint.

While brand-agnostic, Rutledge continues to develop and even third-party manage branded and more likely independent properties with his own Godfrey brand, which is about to open its fourth hotel, in Los Angeles. The group is also developing a 56-story, nearly 500-unit, luxury apartment building on Chicago’s Michigan Avenue, next to its Hotel Essex. In total, the group has about 20 hotels open and another five or six assets close to opening.

The University of Chicago MBA graduate, voracious reader, sportsman and world adventure traveler sat down with HOTELS last week to talk all things hotels, sharing his points of view on the state of the industry, as well as some of the emerging trends.

HOTELS: How do you feel about industry dynamics at the moment?

John Rutledge: I would say we’re cautious. We’ve harvested a lot over the last several years… At this point of the cycle, we think it made a lot of sense to harvest. Now, in many cases we may still be an investor in the transaction, but we’ve round-tripped most of our money and our investors’ money. We’re still in for maybe the next leg, but we’ve taken a meaningful amount of chips off the table. Then we’re continuing to manage and selectively finding spot market opportunities to buy and/or develop, redevelop – but it’s much more little spot market opportunities than super secular arbitrage.

I think the good news is, whatever your politics are, we certainly have a business-friendly government right now that is promoting business and advocating business. I think there are likely to be extra innings in this expansion by virtue of a very business-friendly economic environment. If we were coming up to the eighth or ninth inning, I think there’s going to be extra innings. I think that GDP growth is likely to continue. That doesn’t mean there aren’t going to be quarterly blips, and this is not taking into account some big exogenous event, which can always happen, but I think generally we feel pretty good about GDP growth and therefore demand growth over the next two or three years.

Secondly, there is not a torrent of new supply [in the U.S.]. In other words, we’ve been through cycles where, wow, there was just a wall of new supply coming at all these markets. For the most part, that’s not true. This cycle, New York, obviously is getting a lot of supply and Nashville is getting a lot, but I wouldn’t say it’s like, ‘oh my gosh, all the major masses are getting massive supply hits.’ There’s been a little more discipline in the credit markets and underwriting and a little bit in the construction costs as they continue to go up.

H: What are the issues on the management side of the business?

JR: It’s a tight labor market. People are approaching our people and are getting poached by competitors. There’s wage pressure and there are fewer qualified people out there. I’d say labor availability and cost is maybe the most significant one. Then also just cost pressures, in general, at this stage of the cycle on the operating side.

H: How much has the democratization of distribution impacted your branding decisions?

JR: We probably have a slight predisposition to independence. As an independent entrepreneur I like the flexibility, that open-field running that I can get as an independent. There is more flexibility around management and sales strategies.

H: Can you expand on your plans for your own Godfrey brand?

JR: We are selectively growing the Godfrey brand in key markets around the country. The driver is finding smart real estate investments – either a great site or a great building where we can make a really smart risk adjusted return on the real estate. Then we layer in our branding, management and positioning.

H: Are you always the lead developer for Godfrey?

JR: In most cases we’re the lead developer, but the implication in your question is correct, which is that we are increasingly getting inquiries about managing and taking a smaller piece of the equity. Over time that likely will be an increasing part of our brand growth.

H: What trends are you responding to?

JR: Urban mixed-use… We’re leveraging the urbanization trend of America and the world. We’re also looking across the spectrum from super luxury to micro… We also take pride in food and beverage and are responding to the social nature of the hotels. We have rooftops, activated lobbies and co-working spaces.

H: Any global aspirations for the company?

JR: We’re selectively evaluating Mexico and actively looking at London and the UK. But it will be very opportunity specific.

H: Is there a prediction you’d like to make about your disciplines for 2019?

JR: You’re going to see Airbnb become more like another OTA. There are already hotels using it as a channel, and I think it’s going to be one of many channels that people access.

H: Who inspires you?

JR: I’ve never really had mentors, but I’ve always had role models where I really like how they live their lives. They have always been multi-dimensional life decathletes – people who are very successful in their careers, family lives, and are active in their civic lives. They are well grounded across all the key quadrants of a full life, and that it’s a relatively short list.