An investor group that includes Los Angeles real estate developer Lew Wolff is launching a brand that seeks to attract younger travelers with affordable lodging in desirable downtown locations.

Contributed by Judith Crown

Found Hotels in April opened its first location in Chicago’s trendy River North neighborhood, where it converted a dilapidated single-room occupancy property into a 60-room boutique hotel that will include a steakhouse, coffee bar and basement karaoke bar.

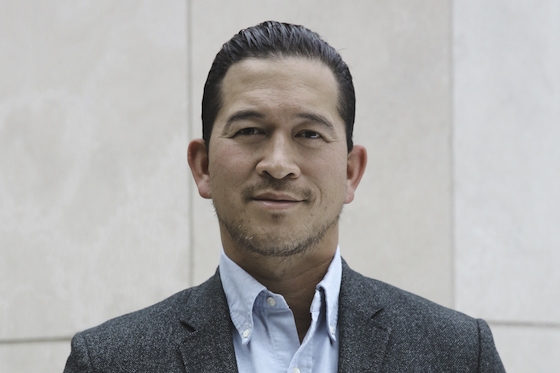

The group plans to roll out seven to 10 properties that it already owns in major cities through 2020, starting with Boston, San Francisco and Los Angeles, owner Ross Walker said in a recent interview. Each will have a mix of shared and private rooms. In Chicago, a bunk in a shared room recently was available for US$30 a night, and a private room with a queen bed was posted at US$89. “Instead of paying US$400 a night in San Francisco, you can pay US$50 for a bed,” Walker said.

Found is the latest in a wave of brands courting peripatetic, budget-minded millennials. To spur growth, major chains including Hilton Worldwide, IHG and Marriott International are moving down-market with the aim of bringing a boutique feel to the budget segment, said Mark Eble, managing director at commercial real estate services firm CBRE in Chicago.

Asian and European operators including AccorHotels, Ascott and Ovolo Hotels recently launched budget lodgings with shared rooms, but that concept is still under the radar in North America. Found’s innovation is offering shared rooms at a rock-bottom price in an A++ location, Eble said. “The big question is whether this is a fad or whether it has staying power.”

The Chicago property has nine communal and 51 private rooms, and that ratio will vary by city, Walker said. The sleeping spaces are small and minimal, with an emphasis on communal spaces such as kitchens and lounges so that guests can interact.

Communal spaces for working and socializing are increasingly important, and not just for 20-somethings. “People don’t want to just sit in their rooms and work,” Eble said.

The real estate calculation

Found aims to find undervalued assets in prime neighborhoods that don’t require a big outlay to renovate, then grow the property’s value by tapping into the growing demand for stylish but simple budget lodgings.

“If you walked by (the Chicago property), you probably wouldn’t even give it a second look,” Walker said. These aren’t US$100 million deals that would attract institutional investors.

Found is teaming with West Hollywood, California-based H.wood Group to run F&B operations, with the concepts to vary by city. The group in Chicago is launching a new steakhouse, Mason, and plans to replicate its successful Los Angeles karaoke bar, Blind Dragon, in the hotels “speakeasy-styled basement.” The company is conservatively forecasting food operations to generate only nominal profit. “We’re making money on the rooms,” Walker said. “Anything else is gravy.”

Found is capitalized with several hundred million dollars, with Wolfe serving as chairman, adviser and investor. He is best known as co-founder of the Maritz-Wolff hotel and resort firm, and formerly of Rosewood Hotels and Fairmont Hotels and Resorts. He served as chairman emeritus of the Oakland Athletics baseball team.

“We thought it best to own and operate everything – keep the brand experience under one umbrella,” Walker said. A longer-term goal is to franchise and/or seek third party management. The buildings, with odd configurations, don’t lend themselves to traditional flag hotels with 10-foot ceilings and three elevators, he said.

Found has the benefit of patient investors, Walker noted, not “hardcore institutions that want their money back in three to five years, regardless of where you are in the cycle.”

“It’s difficult to build a brand if you don’t have patient capital,” he added. The investors believe that if you’re allowed to build and scale the format, there will be value created and good options when it’s time to exit. “We could theoretically hold these for 10 or 20 years if we wanted. Our goal is to maximize return for our investors,” Walker said.