The hotel development universe this year is applying its thinking both inside and outside the box to fight commoditization and keep its properties hot and busy. It’s going modular in its designs and touting memberships to potential guests. And it’s dreaming big, as evidenced by AccorHotels’ Sébastien Bazin, who is thinking more about how his hotels can serve locals.

As part of HOTELS’ 2017 guide to what’s hot in categories like design, wellness, technology, and sales and marketing, we present what’s new and what’s hot in development.

What is trending these days? Read on and get inspired – and stay tuned for more.

Join the club

Soho House brought the membership concept in a bigger way to the hotel business in 1995 and now others, including The Curtain in London and the soon-to-launch Equinox hotel concept, are continuing the momentum.

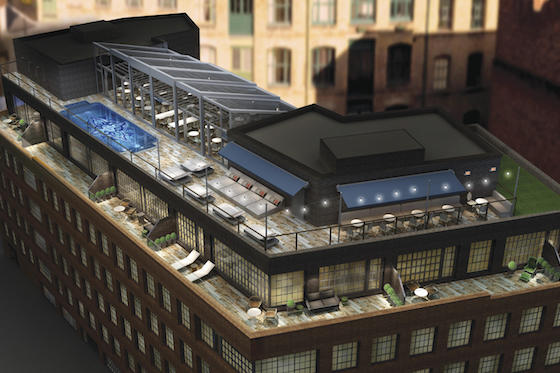

Michael Achenbaum, owner of The Curtain and co-founder of Gansevoort Hotel Group, just opened the US$100 million project in East London’s Shoreditch neighborhood with the requisite rooftop restaurant and pool, 120 guestrooms and suites, Marcus Samuelsson’s first U.K. outpost of Red Rooster Harlem and a “CBGB-inspired” live performance space.

The club at The Curtain provides curated spaces for its members, including a soundproof live performance space and late-night offerings at Billy’s Bar. Club spaces area open from 8 a.m. till 2 a.m. for coffee, juices, breakfast, lunch, cocktails, snacks and all the bits in between. Members-only events will be programmed throughout the week in LP, The Curtain’s Live Performance room comprising secret gigs, DJs, acoustic performances and spoken word. This fall, a members-only co-working space will open on the ground floor of the hotel.

“The competitive landscape of the hotel industry has changed drastically within the last few years with the growth of the sharing economy and the commodification of hotels through OTAs,” Achenbaum says. “For this reason, I wanted to establish a new hotel with a key differentiating factor: world-class service and a private, members-only club… It will be a very social environment, one which encourages new collaborations and friendships.”

Bazin imagines

Sébastien Bazin has a point when he says his brands only take care of a quarter of the 7 billion inhabitants of planet Earth. Why not find a way to serve more humans? Why shouldn’t locals think about the hotel around the corner as a place to pick up their dry cleaning after the local business closes? Why shouldn’t the millions of AccorHotels loyalty club cardholders think about using it for services when at home? Perhaps some would also wander into the happening lobby bar once inside. They don’t need a room key, he says.

Bazin has stated that AccorHotels will double its EBITDA within five years, so creativity is a must, which is why he is asking how to better integrate hotels into their neighborhoods. Answers are starting to come now.

Since May 2016, Accor has engaged a team of 50 to determine what those local services should be, how many should be free and simply act as brand enhancers, how many should be billable, and whether or not there should be a subscription fee and have technology embedded into it.

Then, 10 GMs in Paris started a beta test to see how the assumptions apply. Most of the GMs had never gotten to know neighboring merchants, didn’t know their names. That journey has since begun, educating the local vendors about services they can have rendered at the hotels, as well as educating local dwellers about the possibilities.

What makes the potential more of a reality is the digital concierge service Accor acquired, John Paul, which can help bring the program to life and facilitate the interactions. The revolution at Accor continues. Stay tuned on this idea.

Square pegs

With Marriott International’s April proclamation that it expects to sign 50 deals this year involving modular construction, the process is entering the mainstream.

Estimates have had U.S. modular hotel construction increasing by about 30% in the past few years. Other major companies like Hilton and IHG have been promoting it in places including far-flung destinations across Africa, where it is more challenging to source traditional building materials efficiently.

“We think modular will gain a strong foothold in the hotel industry,” says Marriott’s Eric Jacob, chief development officer for select brands in North America. “This year alone at Marriott, we expect that more than 10% of the deals we sign will involve an element of modular construction, whether guestrooms, bathrooms or both. That type of volume can really change the game.”

Modular gives developers greater control over construction schedules, especially at a time when skilled labor shortages can create challenges to opening on time. “Prefabricating hotel spaces in a factory can reduce a developer’s risk of delays and help them open hotels faster,” Jacob says. “Modular construction can also reduce quality control challenges because it involves an experienced workforce doing repetitive work in an indoor, controlled environment – much like an auto assembly line.”

Are there cost savings? Jacobs says early adapters won’t see significant savings compared with traditional construction. “But our goal with this initiative is to drive the expansion of the modular companies so they can grow and drive economies of scale,” he adds.

Mutuality

Alliances that allow hotel developers and operators to maintain their independence while finding ways to mutually benefit are growing in number and sophistication.

Take Banyan Tree Holdings and AccorHotels, which in December signed a “co-development” deal for Banyan Tree brands. It could serve as a model for mid-sized hotel groups to maintain a leg to stand on in an era of global hotel consolidation.

In this iteration, Banyan Tree can stem the erosion of margins created by high overhead costs associated with growth and spend more of its capital on brand differentiation.

Accor is investing an initial US$17 million for a 5% stake in Banyan Tree with an option to purchase an additional 5% share. Accor will manage the daily operations of the co-developed Banyan Tree hotels sourced by Accor, while Banyan Tree will manage all brand-related issues. GMs will report to Accor operationally but to Banyan Tree on brand standards.

“It could become a transformational change in the relationship between the mega-players and the smaller players,” Banyan Tree founder K.P. Ho says.

In a different iteration, two of Asia’s luxury groups, Hong Kong-based Shangri-La Hotels and Resorts and Mumbai-based Taj Hotels Resorts & Palaces, have introduced the “Warmer Welcomes” program, which integrates the two companies’ loyalty programs and provides members reciprocal benefits. Shangri-La and Taj’s combined 6 million loyalty program get the perks of their elite status; award points in their preferred program at either brand’s hotels; and the ability covert points to redeem awards between both programs.

“As hotel owner-operators who share similar values and service philosophies but have minimal overlap of properties, Taj and Shangri-La are in a unique position to establish a seamless alliance that goes beyond a marketing partnership or multi-hotel distribution platform,” says Shangri-La Acting President Madhu Rao. “We will be able to enhance brand awareness and increase market share.”